Oil & natural gas producer Chevron Corporation (NYSE: CVX) has enhanced its renewable energy portfolio with the acquisition of Renewable Energy Group, Inc. The agreement related to this buyout was signed by the parties in February 2022.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Every share of Renewable Energy Group has been valued at $61.50, bringing the total value of the buyout to $3.15 billion. Shares of Chevron lost 4.6% to close at $167.33 on Monday. However, the stock rose 0.3% in the extended trading session.

Renewable Energy Group has stopped trading on the Nasdaq (effective June 13) under its symbol REGI.

Inside the Headlines

Renewable Energy Group is one of the leading producers of renewable fuels, catering to the demand for cleaner sources of energy in the transportation and energy industries. Its production capabilities and feedstock resources are expected to be advantageous for Chevron.

It is worth noting here that the buyout is in line with the company’s target to produce 0.1 million barrels of renewable fuels daily by 2030.

Also, Chevron anticipates the buyout to boost its earnings per share in the first year of the completion of the transaction.

Management’s Take

Chevron’s Executive Vice-President of Downstream & Chemicals, Mark Nelson, said, “We have brought together companies with complementary capabilities, assets, and customer relationships to make Chevron one of the leading renewable fuels companies in the United States.”

Wall Street’s Take

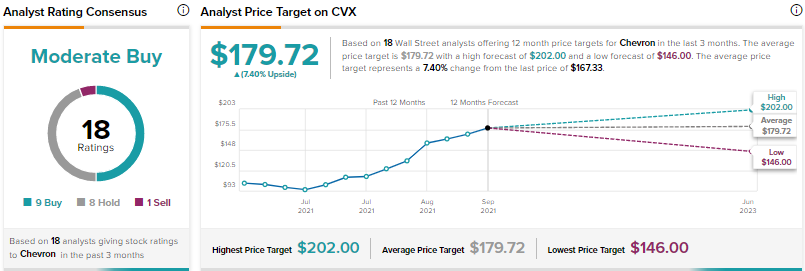

On TipRanks, Chevron has a Moderate Buy consensus rating based on nine Buys, eight Holds, and one Sell. CVX’s price target of $179.72 suggests 7.40% upside potential from current levels. Shares of this $328.8-billion company have surged 55% over the past year.

Five days ago, Manav Gupta of Credit Suisse reiterated a Buy rating on CVX while increasing the price target to $202 (20.72% upside potential) from $190.

A week ago, Neil Mehta of Goldman Sachs maintained a Hold rating on CVX while increasing the price target to $181 (8.17% upside potential) from $160.

Bloggers’ Stance

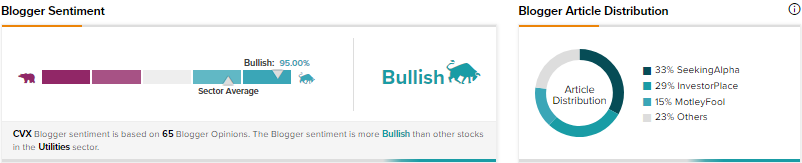

According to TipRanks, financial bloggers are 95% Bullish on CVX, compared with the sector average of 74%.

Conclusion

In the wake of the rising need and demand for cleaner sources of energy, Chevron’s efforts to boost its renewable energy portfolio are commendable. The buyout of Renewable Energy Group is expected to be advantageous in the years ahead.

Read full Disclosure