Cathie Wood’s ARK Invest ETFs (exchange-traded funds) made several notable portfolio moves on Thursday, October 16, showing a stronger focus on fintech and tech stocks. The largest buy came from the ARK Genomic Revolution ETF (ARKG), which purchased 17,134 shares of Genedx Holdings (WGS), valued at roughly $2 million. Genedx is a genetic testing company that uses advanced DNA sequencing to help detect rare diseases. The buy signals ARK’s growing interest in firms that turn genomic data into clinical answers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meanwhile, the ARK Autonomous Technology & Robotics ETF (ARKQ) increased its position in Pony.ai (PONY), buying 17,607 shares valued at roughly $373,000. The move reflects ARK’s steady interest in self-driving technology and new innovation names.

Wood Trims Stakes in Quantum-Si and Brera Holdings

On the sell side, ARKG sold 498,068 shares of semiconductor-based life sciences company Quantum-Si Inc. (QSI), worth about $1.3 million. The company, known for its protein sequencing technology, has seen its stock under pressure amid slower adoption trends.

At the same time, the ARK Innovation ETF (ARKK) made a minor adjustment, selling 202 shares of Brera Holdings (SLMT), a digital assets firm, for about $2,900. Though small, the trade extends ARK’s steady reduction in the stock over the past week. Brera, which formerly traded under the ticker BREA, changed its symbol to SLMT on October 3, 2025.

Wall Street’s Take on WGS, PONY, QSI, SLMT

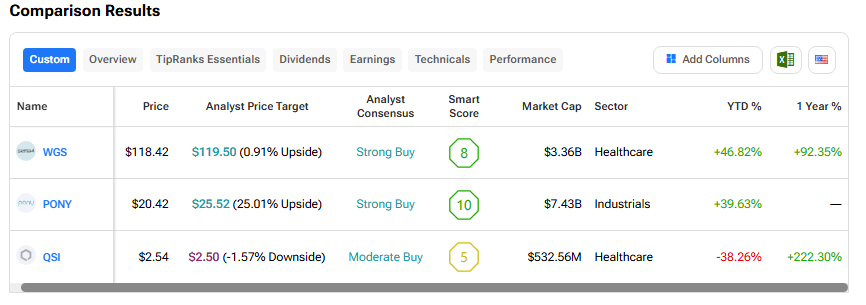

Using the TipRanks Stock Comparison Tool, Genedx carries a Strong Buy rating with a modest 0.9% upside, reflecting steady confidence in its growth potential. Pony.ai also holds a Strong Buy rating and shows the highest upside potential at 25%, backed by optimism around AI and autonomous driving.

In contrast, Quantum-Si has a Moderate Buy rating, with analysts expecting a slight 1.6% downside from current levels.