Fintech company WEX (WEX) has disclosed plans to expand its existing relationship with ChargePoint to solve on-route charging needs in electric vehicles (EV) and enable depot and at-home charging.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

ChargePoint operates EV charging network in North America and Europe. The companies seek to provide integration of EV charging for mixed fleets that include internal combustion engine vehicles (ICE). (See WEX stock charts on TipRanks)

In a release, the company said, “The partnership will allow drivers to locate and activate EV charging stations and authorize payments while providing fleet managers with consolidated billing and reporting and greater visibility into internal combustion engine and electric vehicle usage.”

The President of Global Fleet at WEX, Scott Phillips, said, “By expanding WEX’s relationship with ChargePoint, we expect to position both companies to serve our customers’ full range of needs over the long-term, as more businesses evolve their fleets in efforts to address climate change.”

On September 15, Mizuho Securities analyst Dan Dolev maintained a Buy rating on WEX with a price target of $235 (40% upside potential from the current level).

Dolev said, “Our work suggests that the fleet business should return to past growth rates despite the advent of electric vehicles. Adjacent businesses like virtual card and travel should help propel growth.”

Consensus among analysts is a Moderate Buy based on 4 Buys and 3 Holds. The average WEX price target stands at $225.43 and implies upside potential of 34.3%. Shares of the company have gained 19.3% over the past year.

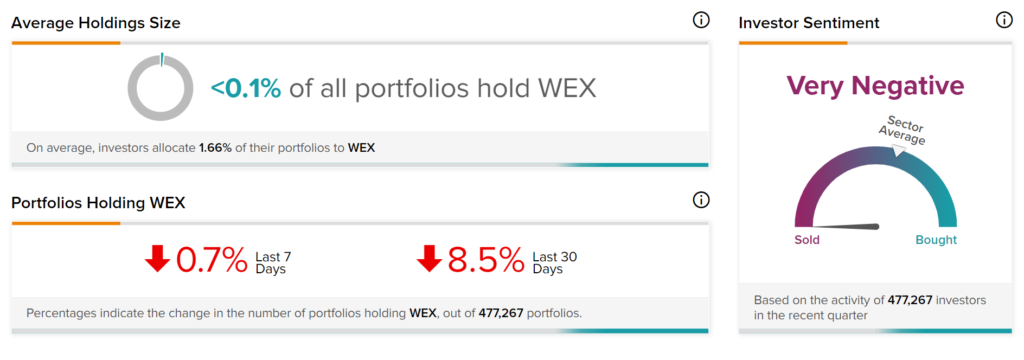

TipRanks’ Stock Investors tool shows that investors currently have a Very Negative stance on WEX with 8.5% of investors on TipRanks decreasing their exposure to WEX stock over the past 30 days.

Recent News:

Salesforce Launches Health Cloud 2.0; Analysts Remain Bullish

Celestica Signs All-Cash Deal to Buy PCI Limited

JPMorgan Hikes Quarterly Dividend by 11.1%