SanDisk China, a wholly-owned subsidiary of data storage manufacturer Western Digital (NASDAQ:WDC), will sell an 80% stake in its Shanghai facility, SanDisk Semiconductor (SDSS), to Chinese chip assembly and testing firm JCET Group for $624 million in cash. The transaction is expected to close in the third quarter of this year. Once this equity purchase agreement closes, JCET will own 80% of SDSS, while SanDisk China will own the remaining 20%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

This transaction values SDSS at $780 million, and JCET will pay the $624 million over five years. Western Digital aims to use the proceeds to enhance its financial position as it moves to separate its Hard Disk Drive (HDD) and Flash drive businesses.

Is WDC Stock a Good Buy?

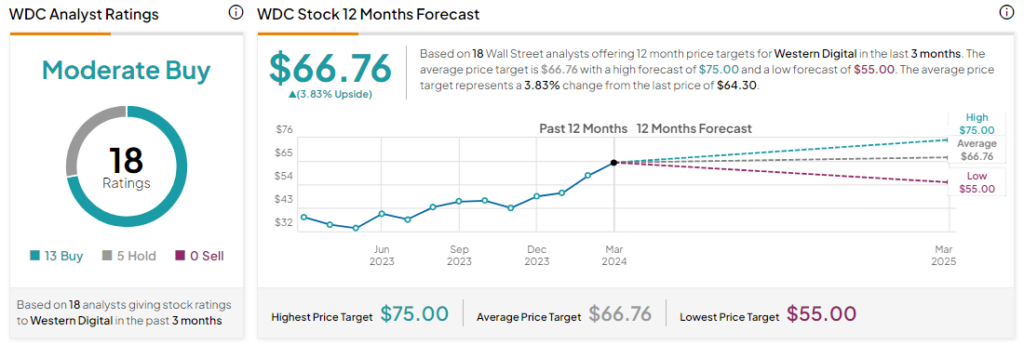

Analysts remain cautiously optimistic about WDC stock with a Moderate Buy consensus rating based on 13 Buys and five Holds. Over the past year, WDC stock has surged by more than 70%, and the average WDC price target of $66.76 implies an upside potential of 3.8% at current levels.