Shares of Western Alliance (NYSE:WAL) increased by more than 7% on Tuesday’s extended trading session and another 8% at the time of writing. The upside came after the company disclosed that its second-quarter deposits balance increased by more than $2 billion as of May 12.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Since the last update provided by the company, deposits have increased by another $200 million, according to the most recent data. On May 11, Western Alliance reported that quarter-to-date deposits had increased by $1.8 billion from $47.6 billion at the end of March.

Further, at the second-quarter investor update yesterday, the company said that insured deposits now account for more than 79% of all deposits, up from 68% as of March 31.

Deposits have remained a key concern among investors since the failures of Silicon Valley Bank and Signature Bank triggered a deposit run in March. Western Alliance’s first-quarter results, which were just released, showed a sequential deposit decline of 11%.

Fascinatingly, the company has already surpassed its $2 billion quarter-on-quarter deposit growth outlook. Thus, investors will closely watch for further updates from the management on revised expectations.

Is WAL Stock a Good Buy?

It is important to note that Michael Burry, the founder of Scion Asset Management, recently showed his fondness for bank stocks. He purchased 125,000 shares of Western Alliance, as per the recent 13F filing.

WAL stock has a Strong Buy consensus rating based on 11 Buy and two Hold recommendations. Also, the analysts’ average price target of $53.79 implies a solid upside potential of 70.3%. Shares have declined 45% so far in 2023.

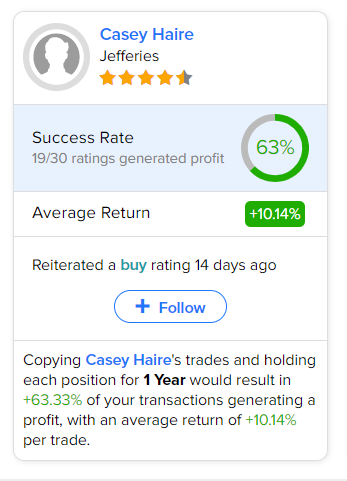

Looking to invest in this stock? One can follow Jefferies analyst Casey Haire. Based on TipRanks’ data, he is the most accurate analyst for WAL stock. Replicating Haire’s position for one year would result in 63% of transactions generating a profit, with an average return of 10.1% per trade. Interestingly, the analyst reiterated a Buy rating on the stock about two weeks ago.