There were those who thought bank stock Western Alliance Bancorp (NYSE:WAL) was poised for a sale. That was enough to send share prices plummeting over 60% at one point in Thursday’s trading. It’s still down just over 27% at the time of writing, however, after management came out and made it clear the rumor in question was just that – a rumor.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A report from the Financial Times detailed how Western Alliance had called in a slate of advisors to look into a range of competitive options. One such option, naturally, was a full sale to someone else. That was enough to spark a selling frenzy, which halted Western Alliance stock from trading more than 10 times this morning alone. Yet, management came out and made clear: the rumor was nothing more than a rumor and that the article in question was “…categorically false in all respects.”

Management also noted that it was “considering all of our legal options in response to today’s article.” What precisely that entails is unclear, but potentially could go all the way up to lawsuits. Indeed, Western Alliance previously noted that its total deposits had risen from $47.6 billion at the end of March to $48.8 billion in the most recent numbers. That certainly doesn’t seem like a bank about to go into a selloff.

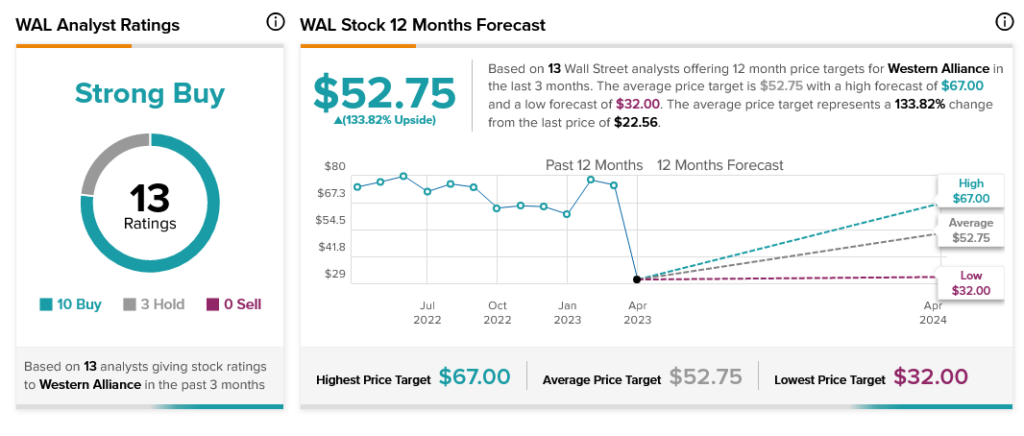

However, regardless of the bank’s actual position, analysts are clearly behind it. With 10 Buy ratings and three Holds, WAL stock is considered a Strong Buy by analyst consensus. Further, with an average price target of $52.75, it offers investors 133.82% upside potential.