West Pharmaceutical Services (NYSE:WST) received a Buy rating from Bank of America Securities analyst Derik De Bruin yesterday despite the company reporting mixed third-quarter results and lowering 2023 sales guidance. WST stock declined about 9% in yesterday’s regular trading session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The analyst’s Buy rating is based on the improved full-year EPS guidance and strong performance of the company’s Contract Manufactured Products segment, fueled by injector devices and diagnostics. Even though the company lowered its 2023 sales expectations, De Bruin remains bullish on the stock as he considers WST to be a major player in the drug packaging market.

WST’s Q3 Performance

The company reported Q3 adjusted EPS of $2.16 increased by 6.4% year-over-year, surpassing consensus estimates of $1.86. Meanwhile, the company posted revenues of $747.4 million in the quarter, up 8.8% year-over-year, but lagged behind Wall Street’s expectations of $750.3 million. West Pharmaceutical’s performance was impacted by a slowdown in restocking trends by large Pharma and Generic customers.

Looking ahead, the company has lowered the full-year 2023 sales outlook. It now expects to report in the range of $2.95 billion to $2.96 billion, compared to a prior range of $2.97 billion to about $3 billion. However, it raised the full-year adjusted EPS guidance to $7.95 to $8.00 from the previous range of $7.65 to $7.80.

It is worth mentioning that WST also raised its fourth-quarter 2023 dividend by 5.3% to $0.20 per share. This marks the thirty-first consecutive annual increase in the company’s dividend.

What is the Price Target for WST?

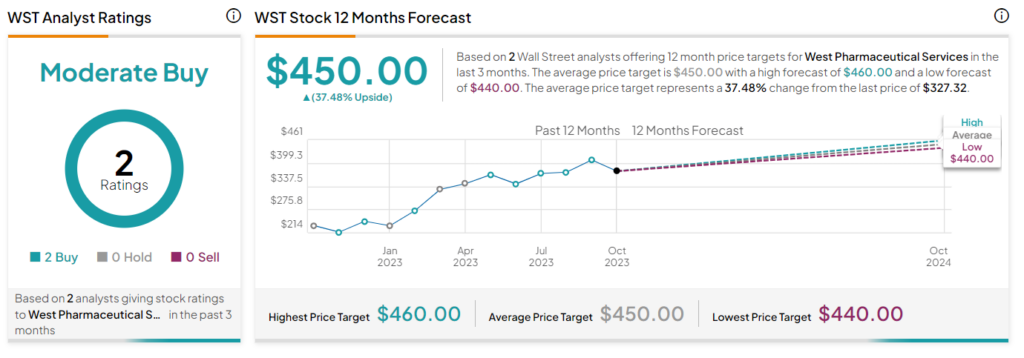

On TipRanks, West Pharmaceutical stock has a Moderate Buy consensus rating based on two Buys. The average stock price target of $450 implies a 37.5% upside potential. The stock is up more than 39% so far in 2023.