West Fraser Timber Co (NYSE:WFG) (TSE:WFG) reported better-than-expected Q3-2022 results yesterday, topping both earnings and revenue estimates.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Based in Canada, West Fraser Timber Co. Ltd. is a diversified wood products company making lumber, engineered wood products, wood chips, plywood, pulp, newsprint, and other products.

A Snapshot of WFG’s Q3-2022 Results

Adjusted earnings of $2.50 per share massively beat the consensus estimate of $1.74 per share. However, it was much lower compared to earnings of $7.59 per share in the prior-year period.

Meanwhile, total sales declined 27.8% year-over-year to $2.09 billion but exceeded consensus estimates by $210 million.

During the quarter, the company repurchased 2.224 million shares worth $182 million.

Looking ahead, CEO Ray Ferris commented, “We are pleased to announce the planned addition of a new state-of-the-art lumber manufacturing complex with the brownfield development at our Henderson, Texas facility.”

He added, “This project is another important step in our strategy of optimizing our lumber portfolio by continuously driving cost efficiency through deployment of advanced technologies utilized by our skilled and engaged teams.”

Is West Fraser Timber Stock a Buy?

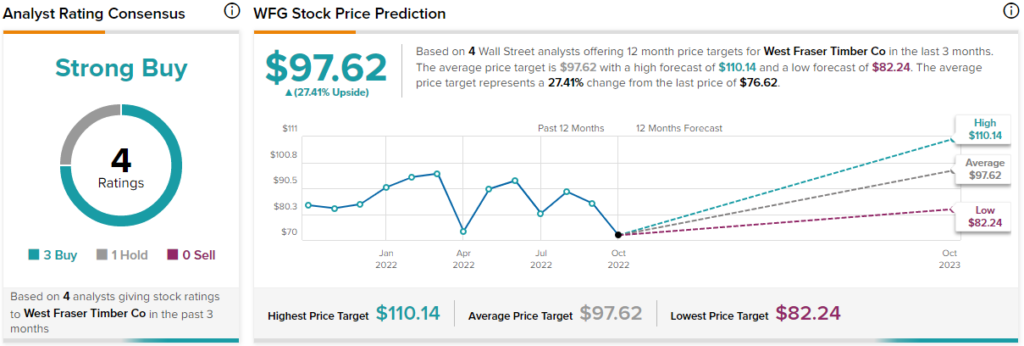

The Wall Street community is clearly optimistic about the stock. Overall, WFG stock commands a Strong Buy consensus rating based on three Buys and one Hold. West Fraser Timber’s average price target of $97.62 implies 27.4% upside potential from current levels.