Shares of Wendy’s (NASDAQ:WEN) initially opened higher today, which may be attributed to an analyst upgrade. Indeed, John Staszak of Argus changed his rating on the stock from Hold to Buy while assigning a price target of $26 per share. However, the stock has since slipped into negative territory due to the broader market’s selloff.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Staszak predicts a bright future for Wendy’s, citing new store openings, a solid growth rate internationally, and ongoing digital investments. Wendy’s emphasis on expanding its breakfast offerings could also lead to an increase in same-store sales.

Staszak also believes Wendy’s shares are currently a bargain, trading at just 23 times the firm’s 2023 earnings-per-share forecast, a figure lower than the average of its industry competitors. Wendy’s also offers an attractive dividend, providing a yield of roughly 4.3%, significantly surpassing the 1.8% average yield seen among other restaurant chains.

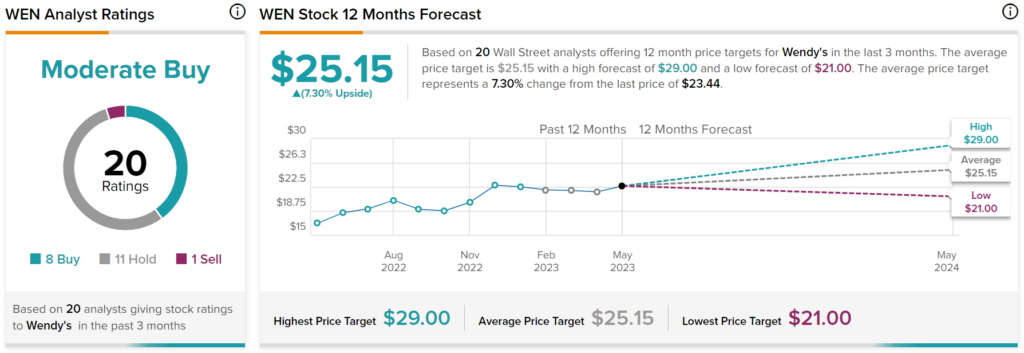

Overall, Wall Street analysts have a consensus price target of $25.15 on WEN stock, implying over 7% upside potential, as indicated by the graphic above.