While food prices, in general, have been on the rise for the last several years now, at least we could usually tell what the prices would be from one week to the next. That may be about to change as quick-service restaurant Wendy’s (NASDAQ:WEN) looks to shake up its operations with what it calls “dynamic pricing.” However, Investors weren’t enthusiastic about it, as Wendy’s shares slipped fractionally in the last minutes of Monday’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

If that term sounds familiar, you may have heard something similar described by Uber (NASDAQ:UBER) when it comes to pricing a ride-share. Essentially, Wendy’s looks to be able to adjust the price of food up or down depending on the time of day or other trends, and it expects to start that up in 2025. Wendy’s is looking to drop $20 million into upgrading its restaurants’ display systems with the new pricing options and will update restaurants’ pricing automatically.

A Side of Torches and Pitchforks

It’s likely you’ve already seen one of the biggest concerns about such a plan coming: consumer backlash. It’s a safe bet that customers, already reeling from food inflation that’s up around 25% for the last five years, aren’t going to be interested in playing Burger Roulette with their wallets to see if their dinner of choice will be slightly less expensive depending on a range of factors they may not even understand.

Indeed, the early strategy will already see prices go up during “…the lunch and dinner rush..” a move that will do little more than send customers to other restaurants or shuffle the rush times to a different time in a bid to avoid the price hikes. And with Wendy’s already considered the priciest of fast food—prices are up 35% in the last two years alone—this won’t help.

Is Wendy’s Stock a Good Buy?

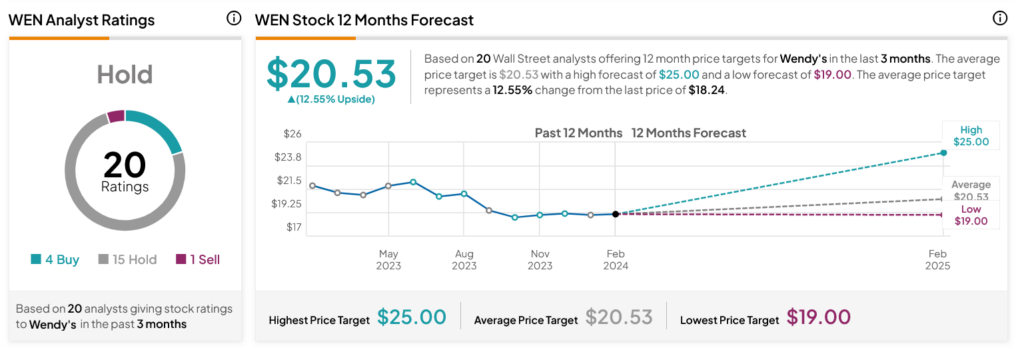

Turning to Wall Street, analysts have a Hold consensus rating on WEN stock based on four Buys, 15 Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 13.96% loss in its share price over the past year, the average WEN price target of $20.53 per share implies 12.55% upside potential.