Wells Fargo (WFC) remains bullish on U.S. stocks.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The leading American bank has raised its year-end 2025 target for the benchmark S&P 500 to 7,100. That’s nearly 5% higher than where the index is currently at. The S&P 500 has never closed above the 7,000 mark. Its all-time high was reached on Oct. 29 of this year when it closed at 6,890.89.

Wells Fargo analysts cited continued buying of stocks by retail investors and improving liquidity as reasons for the U.S. market to continue its bull run into the end of December. If earnings grow at least 10% annually between 2025 and 2027, Wells Fargo says that the S&P 500 could deliver around 8% total return per year over the next five years, reaching 9,500 by 2030.

Bull Case

Wells Fargo adds that while concerns over consumer weakness, layoffs, and market corrections are high right now, the upcoming government reopening and a potential December rate cut from the U.S. Federal Reserve are likely to support a “risk-on rally” in coming weeks.

Lastly, related to worries over artificial intelligence (AI) spending, Wells Fargo says that big capital expenditures from technology giants such as Meta Platforms (META) and Alphabet (GOOGL) are “a must to stay competitive,” which will likely prolong the AI investment cycle.

Is the SPDR S&P 500 ETF Trust a Buy?

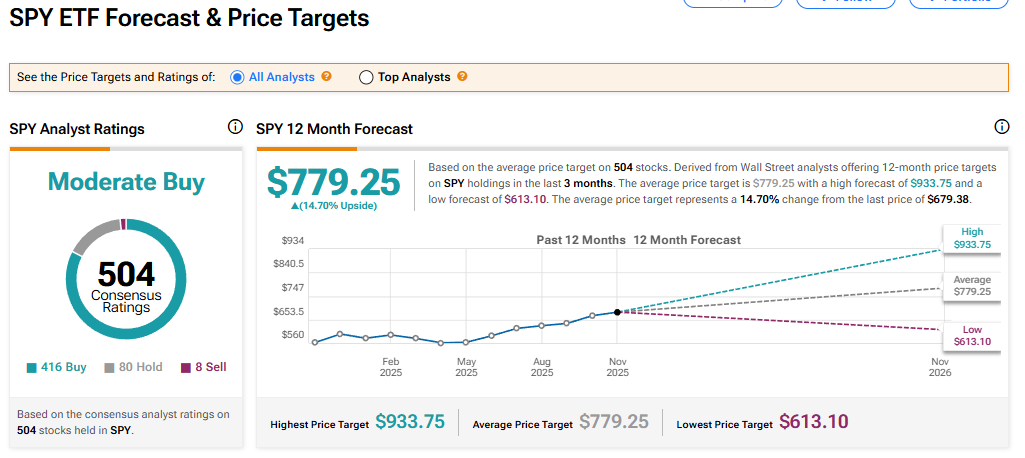

The SPDR S&P 500 ETF Trust (SPY) currently has a Moderate Buy rating among 504 Wall Street analysts. That rating is based on 416 Buy, 80 Hold, and eight Sell recommendations issued in the last three months. The average SPY price target of $779.25 implies 14.70% upside from current levels.