The Wall Street Journal reported that Wells Fargo (NYSE: WFC) has agreed to pay $1 billion to settle a class-action lawsuit brought by its shareholders. The lawsuit alleged that the bank misled investors about its sales practices, resulting in significant financial losses.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The lawsuit, filed by shareholders in 2018, accused Wells Fargo of misleading investors about the bank’s sales practices, resulting in significant financial losses. The plaintiffs argued that the bank’s senior executives failed to disclose the extent of the fraudulent account scandal that had plagued Wells Fargo for years.

The settlement aims to compensate shareholders for their losses and enhance the bank’s corporate governance practices and risk management procedures. The settlement is subject to court approval.

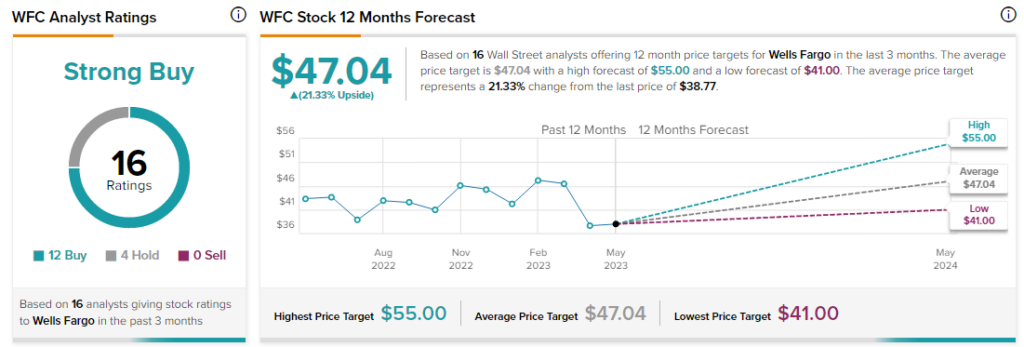

Analysts remain bullish about WFC stock with a Strong Buy consensus rating based on 12 Buys and four Holds.