Normally, stories of layoffs and job cuts give share prices a helping hand. It’s a demonstration to make the tough choices for the sake of the business, not to mention huge cost savings. Leaving aside the obvious disaster that job loss is, it’s often a big help to the business itself. But perhaps bank stock Wells Fargo (NYSE:WFC) discovered that there’s such a thing as too much of a good thing, down significantly in Tuesday morning’s trading after revealing the bill for its job cutting.

Wells Fargo revealed that its staff turnover rates were surprisingly low, which meant it was going to have to do some manual cutting on its own. That’s due to a combination of factors ranging from slumping deal bookings, rising costs of funding, and the growing potential for losses in the lending department. And that, in turn, means severance packages for all those who are about to be shown the door.

The severance costs are going to be substantial, noted CEO Charlie Scharf, and should come in somewhere between $750 million and $1 billion outright. The continuing “focus on efficiency,” as Scharf put it, won’t come without cost, and that butcher’s bill will be downright massive.

Former Wells Fargo CEO Tim Sloan Files Lawsuit

Those costs will be rough enough, but at least they come with future savings attached. One big payout now to prevent lots of smaller payouts later has some business sense attached to it. But then there’s another, much larger issue afoot in the form of former CEO Tim Sloan. Sloan filed suit against Wells Fargo, seeking over $34 million in back pay the company allegedly withheld after Sloan’s departure.

Sloan departed the company after one of the worst periods in its history, in 2019, when a series of fake customer accounts came to light as low-level bank staffers established them in order to meet sales metrics. Sloan declared himself a “scapegoat” for the scandals and that he worked to reverse such policies rather than encourage them himself.

Is Wells Fargo Stock a Buy or Sell?

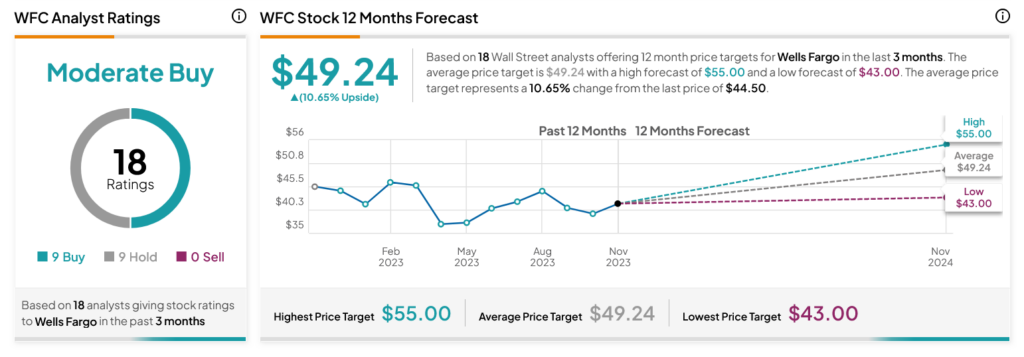

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WFC stock based on nine Buys and nine Holds assigned in the past three months, as indicated by the graphic below. After a 5.96% rally in its share price over the past year, the average WFC price target of $49.24 per share implies 10.65% upside potential.