In a move to return capital to its shareholders, banking giant Wells Fargo (NYSE:WFC) raised its quarterly dividend to $0.35 a share from $0.30. In addition, the financial services company rolled out a new $30 billion share buyback plan.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company’s CEO, Charlie Scharf, said that WFC continues to invest in its risk and control infrastructure, which is its priority. Despite these significant investments, Wells Fargo’s capital levels are strong, enabling the company to enhance its shareholders’ returns through higher dividend payments and share repurchases.

The increased dividend will be paid on September 1, 2023, to shareholders of record on August 4.

The move follows the company’s stronger-than-expected Q2 earnings, led by higher NII (net interest income) and cost control measures. During the Q2 conference call, Scharf said that WFC repurchased $8 billion worth of stock in the first half of 2023, and the stress test results indicate that it can continue to buy back stock.

As WFC focuses on enhancing its shareholders’ value, let’s check what the Street recommends for the stock.

Is WFC Stock a Good Buy Now?

Wells Fargo’s strong balance sheet and focus on increasing its earnings, competitive positioning, and financial and credit risk management augur well for growth. The company delivered solid NII in Q2, which was up 29% year-over-year. At the same time, its overall credit quality remained strong, and its efficiency ratio improved.

Wells Fargo raised its full-year NII growth guidance. It expects NII to increase by 14% in 2023, up from its earlier guidance of 10%. A modest increase in loans and higher interest rates will likely drive its NII.

Goldman Sachs analyst Richard Ramsden reiterated his Buy recommendation on WFC stock following solid Q2 performance and higher NII guidance on July 14. The analyst also raised his earnings estimates for 2023, 2024, and 2025.

Including Ramsden, WFC stock has received eight Buy recommendations. Meanwhile, seven analysts maintain a Hold. Overall, Wells Fargo stock has a Moderate Buy consensus rating on TipRanks. Analysts’ average price target of $48.84 implies 7.39% upside potential.

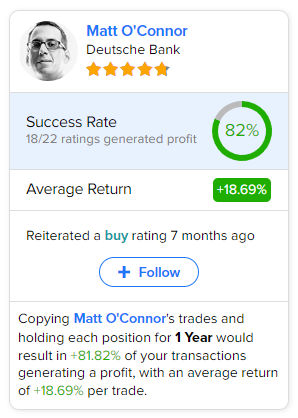

Investors should note that Matt O’Connor of Deutsche Bank is the most accurate analyst for WFC stock, according to TipRanks. Copying his trades on WFC stock and holding each position for one year could result in 82% of your transactions generating a profit, with an average return of 18.69% per trade.