Shares of financial services giant Wells Fargo (NYSE:WFC) are ticking higher in the pre-market session today after its third-quarter numbers came in better than anticipated. Revenue rose 6.6% year-over-year to $20.86 billion, outperforming estimates by $790 million. EPS of $1.48 also came in ahead of estimates by $0.24.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the quarter, while average loans declined to $943.2 billion from $945.5 billion a year ago, average deposits also decreased to $1,340.3 billion from $1,407.9 billion a year ago. The company sold private equity investments to the tune of $2 billion in Q3.

Further, while Wells Fargo is benefitting from the current environment of higher interest rates, its expenses are also dropping owing to lower operating losses. Importantly, the company’s return on equity improved to 13.3% from 8.1% in the year-ago period.

Will WFC Stock Go Up?

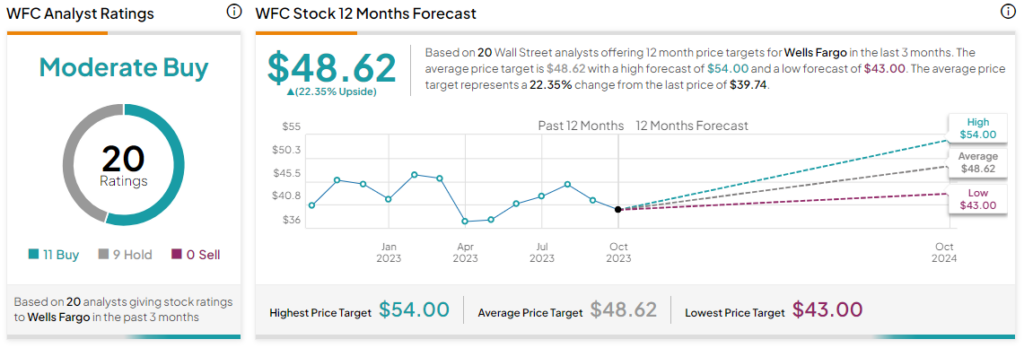

Overall, the Street has a Moderate Buy consensus rating on Wells Fargo. The average WFC price target of $48.62 implies a substantial 22.3% potential upside. That’s after a nearly 5% drop in the share price over the past month.

Read full Disclosure