Wells Fargo (NYSE:WFC) is targeting the private debt market. The company is focusing on providing direct lending services to middle-market companies in North America. The bank has teamed up with the private equity firm Centerbridge Partners to achieve this goal. Centerbridge will establish a business development entity (an investment vehicle) called Overland Advisors, dedicated to offering private credit and direct lending solutions.

Notably, the private debt market continues to present significant growth prospects for companies operating in this sector.

The business development company has set its sights on securing at least $5 billion in investable capital, including $2.5 billion in equity commitments. It’s worth highlighting that wholly owned subsidiaries of the Abu Dhabi Investment Authority and the British Columbia Investment Management Corporation are anchor investors and provide nearly $2 billion in initial equity commitments.

Wells Fargo will also provide an equity investment in the venture. Moreover, it has the opportunity to extend loans to its extensive middle-market customer base as a viable alternative to other available financing solutions. With this move, Wells Fargo has joined a growing list of banks expanding in the private credit arena, as reported by Bloomberg.

Is Wells Fargo Stock Predicted to Go Up?

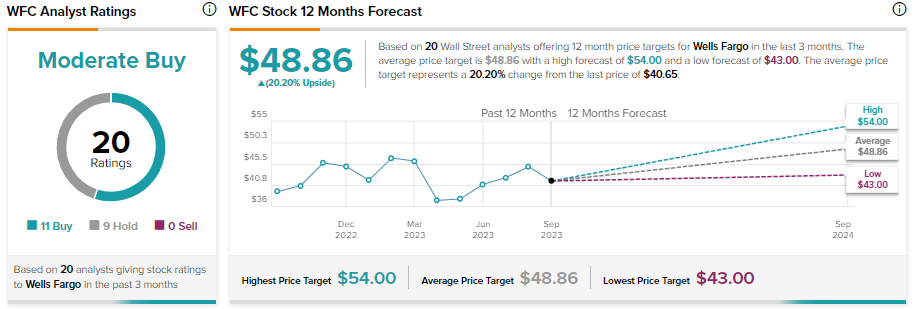

Based on analysts’ average price target, Wells Fargo stock has decent upside potential. The financial services giant is benefitting from a higher interest rate environment and increased loans. Further, it is focusing on cutting costs and driving efficiency to cushion its earnings. However, the decline in deposits and macro uncertainty keep analysts cautiously optimistic about the stock.

With 11 Buys and nine Holds, Wells Fargo stock has a Moderate Buy consensus rating. Analysts’ average price target of $48.86 implies 20.2% upside potential from current levels.