Yesterday, we tackled the notion of a deal between Netflix (NASDAQ:NFLX) and Paramount (NYSE:PARA), and how Netflix could absolutely use a big slug of franchise assets like that. While the deal may or may not ever materialize, Wells Fargo definitely liked the idea, though investors were perhaps a bit more hesitant. Both Netflix and Paramount were down fractionally in Thursday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Essentially, Wells Fargo—via analyst Steven Cahall—noted what a lot of us saw yesterday. Netflix buying Paramount would mean a whole lot of new assets for Netflix to put to use. The studio assets involved would be, as Cahall calls them, a “rare gem” that would make for brisk interest should Paramount decide to go up for sale. It would definitely attract interested buyers, but Cahall isn’t sure that Paramount would ever place itself for sale to begin with. Sumner Redstone, when he was alive, was directly and publicly opposed to a sale. Shari Redstone, meanwhile, seems no different after doubling down on direct-to-consumer operations.

Though certainly, Netflix could use a big studio with production capacity and a body of work ready to take advantage of, Paramount isn’t the only potential target. Netflix already bought Animal Logic—an Australian animation studio—just last year. It also bought the Roald Dahl Story Company, which opens up new options. But Netflix is starting to look for much bigger opportunities in mergers and acquisitions, and that means a major studio. With over $6.7 billion in cash on hand as of its first-quarter earnings report, Netflix has the means and the motive to make a serious move.

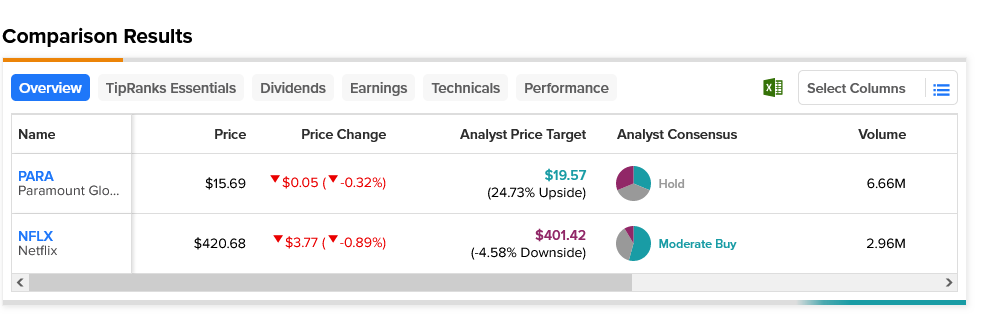

Buying Paramount would likely be good for Netflix, especially given the disparities in the two. Paramount, considered a Hold by analyst consensus, offers 24.73% upside potential with a $19.57 average price target. Meanwhile, Netflix stock—a Moderate Buy—actually has 4.58% downside risk thanks to its average price target of $401.42.