Shares of WELL Health Technologies (TSE: WELL) finished 5.43% higher today following the company’s update regarding its strong business performance in the United States.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

WELL has a few businesses in the U.S: Wisp, Circle Medical, and CRH Medical. Wisp and Circle Medical saw 124% year-over-year organic growth in Q3 while being adjusted-EBITDA profitable and having a greater than US$100 million annual revenue run rate. This is notable because WELL Health’s prior guidance called for the US$100 million revenue run rate to be achieved in Q4.

Also, in Q1, the run rate of these two businesses was just US$70 million. 116,989 patients visited Circle Medical in Q3, a 230% year-over-year growth rate. Wisp saw high growth as well, as its consultations grew by 50% year-over-year, reaching 186,952 in the quarter.

Regarding CRH Medical, it acquired Grand Canyon Anesthesia (GCA), and this acquisition is expected to create more than US$2 million in adjusted EBITDA, along with over US$16 million in revenue. WELL Health expects to reveal its Q3 patient visit metrics in the next few weeks – before its earnings release.

Is WELL Health Technologies a Buy, According to Analysts?

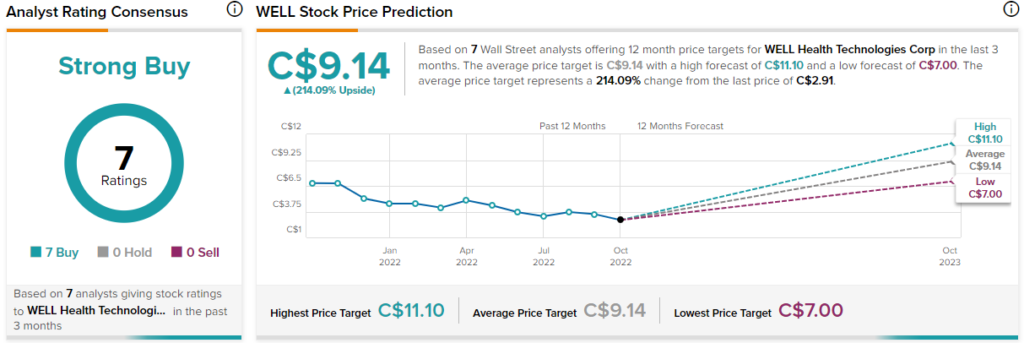

Analysts are all bullish on WELL stock, as it has seven unanimous Buy ratings, making it a “Strong Buy.” The average WELL Health stock price target of C$9.14 implies about 214% upside potential.

Following the news today, Stifel GMP analyst Justin Keywood reiterated a Buy rating on WELL stock, giving it a C$13.50 price target.

When talking about CRH Medical’s acquisition, Keywood stated, “GCA expands CRH’s geographic presence further into western U.S. territories and services outside of gastrointestinal procedures. WELL’s stock continues to be under pressure, following broader sector headwinds and trades at 1.6x FY22E sales versus peers at 2.8x.”

Conclusion: WELL Health Continues to Perform Well

WELL Health has been consistently generating solid results. Yet, the stock is near lows. However, today’s news (along with the market’s rally) helped WELL stock rally over 5%.

Being an acquisitive company, WELL Health is well-positioned to take advantage of the depressed multiples of other companies in order to get better deals.

On top of CRH Medical’s GCA acquisition, WELL Health announced last week that it will be buying assets from CloudMD (TSE: DOC) in what looks like an attractive deal. Analysts are highly bullish as well. Therefore, WELL is a stock worth considering.