Earlier today, WELL Health Technologies (TSE:WELL), a digital healthcare services provider, posted record Q2 earnings results, beating revenue expectations and earnings-per-share (EPS) expectations. The company also boosted its 2023 revenue guidance. As a result, the stock is currently higher on the day.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Q2-2023 Results

In Q2 2023, WELL Health reported record revenue of C$170.9 million (vs. the C$170 million consensus estimate), a 21.8% year-over-year increase. This growth was primarily propelled by organic growth of 15%. Meanwhile, adjusted EPS came in at C$0.06 compared to the C$0.08 figure of Q2 2022 and the consensus estimate of C$0.05. Also, WELL’s adjusted EBITDA rose to a record C$27.8 million, a 5.1% year-over-year increase.

Further, the company lowered its leverage ratio “of net bank debt to shareholder Adjusted EBITDA” year-over-year from 3.0x to 2.3x. However, its adjusted gross profit margin fell from 53.8% in Q2 2022 to 53.1%.

Updated 2023 Guidance

WELL also increased its 2023 annual revenue guidance. While the revenue range of C$740 million to C$760 million remains unchanged, WELL Health now expects to hit the high end of the range. WELL Health also reaffirmed that its 2023 adjusted EBITDA will grow by more than 10% year-over-year.

Importantly, WELL Health’s CEO stated, “The recently announced acquisitions of CarePlus and the clinical assets of MCI OneHealth, coupled with OceanMD’s momentous contract win in the Province of British Columbia gives us confidence in increasing our expectations for 2023 revenue to be over $750 million and pave the way for our push to surpass $1 billion in revenues within a couple of years.”

Is WELL Health Stock a Buy, According to Analysts?

On TipRanks, WELL Health stock comes in as a Strong Buy based on eight unanimous Buy ratings assigned in the past three months. At C$8.46, the average WELL Health stock price target implies 85.9% upside potential.

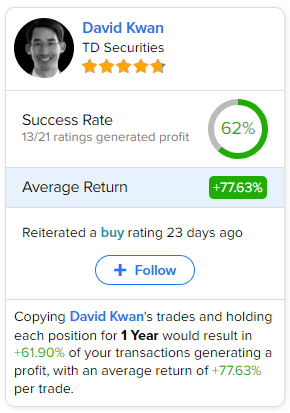

If you’re wondering which analyst you should follow if you want to buy and sell WELL stock, the most accurate analyst covering the stock (on a one-year timeframe) is David Kwan of TD Securities, with an average return of 77.63% per rating and a 62% success rate. Click on the image below to learn more.