Financial services major Wells Fargo & Company (NYSE: WFC) recently revealed that it has entered into a partnership with Mastercard and Bilt Rewards, a leading loyalty program for renters, to become the official issuer of the Bilt Mastercard. The new co-brand credit card, which carries no annual fee, gives reward points to renters for timely rental payments.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Following the news, shares of the company declined 1.4% on Monday. The stock, however, pared its gains slightly to close at $51.87 in the extended trading session.

The Bilt Mastercard also features World Elite Mastercard benefits like access to exclusive offers with select merchants, advanced security features and others.

Management Commentary

The Head of Partnerships and Branch Cards at Wells Fargo, Dan Dougherty, said, “We are thrilled to partner with a game-changing loyalty program like Bilt Rewards. Rent is the single largest expense for the vast majority of American renters, yet it’s never been a tool that helps consumers confidently enter the housing market. As the new issuer of the Bilt Mastercard, Wells Fargo can now help renters with the card take their biggest expense and turn it into a rewarding experience, including helping them build a path to homeownership.”

Stock Rating

On March 28, Morgan Stanley analyst Betsy Graseck reiterated a Buy rating on the stock. The analyst, however, lowered the price target from $72 to $66, which implies upside potential of 27.4% from current levels.

Consensus among analysts is a Strong Buy based on 12 Buys and four Holds. The WFC average price target of $61.84 implies upside potential of 19.4% from current levels. Shares have gained 34.8% over the past year.

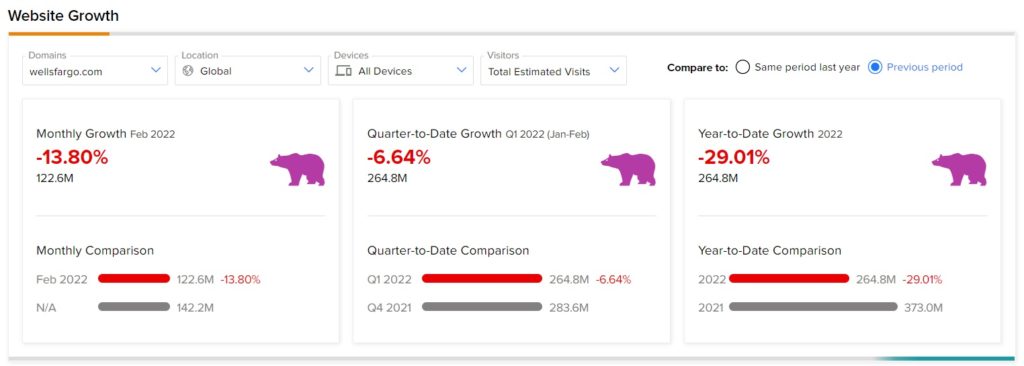

Website Traffic

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into Wells Fargo’s performance this quarter.

According to the tool, the Wells Fargo website recorded a 13.80% monthly decline in global visits in February, compared to the same period last year. Further, the website traffic has declined 29.01% year-to-date, compared to the previous year.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Tesla Considers Another Stock Split, Shares Up 5%

KKR & GIP close $15.1B CyrusOne Acquisition

HP to Snap Up Plantronics for $3.3B; Shares Slip 1.5% Pre-Market