CoreWeave (NASDAQ:CRWV) stock has been gaining recognition as one of the key players in the AI infrastructure space. In a market where alignment with the industry’s leading names can make all the difference, CoreWeave has earned endorsements from several influential partners, strengthening its position in the fast-growing AI ecosystem.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Loop Capital analyst Ananda Baruah underscores this momentum, calling CRWV the largest of a new wave of “Neoclouds” now being welcomed into what he describes as the “Cool Kids Club” – a select group invited to collaborate with Nvidia, the Hyperscalers, and leading AI labs, including those at the forefront of frontier model development.

According to Baruah, this invitation carries real weight. The “Cool Kids Club” Neoclouds aren’t simply partners of convenience; they’ve become a strategic necessity. The analyst describes them as “too important to fail” and even “important enough to prosper,” underscoring how critical they’ve become in the broader AI supply chain.

For Nvidia in particular, Neoclouds function as a de facto “Data Center Arm.” With more of the ecosystem’s business value and intellectual property shifting toward data center design and operations, Neoclouds give Nvidia three distinct advantages: a say in building and managing next-gen data centers, the ability to expand into new software revenue streams (such as Enterprise OS and NIMS), and a buffer against competition from custom silicon developed by the Hyperscalers.

That reliance extends to the Hyperscalers themselves, who are leaning into Neocloud partnerships for two “durable reasons.” First, they can’t construct data centers quickly enough on their own – falling behind creates bottlenecks that are hard to overcome. Second, rebalancing spend by shifting Capex into Opex has become increasingly appealing.

This explains why many Hyperscalers and frontier model builders – companies like OpenAI, Anthropic, xAI, and Google DeepMind – have already locked in formal partnerships with at least one Neocloud. And crucially, Baruah notes, the pace of these tie-ups has accelerated significantly through 2025.

Against that backdrop, CoreWeave stands out. Thanks to its “first mover at scale status,” broad footprint in North America and Europe, and deep ties with heavyweights such as Nvidia (which owns 6.5% of the company), Microsoft, OpenAI, Google, and Meta, the company is strategically positioned to benefit as the landscape shifts. Here, Baruah stresses the importance of keeping perspective: in such a rapidly evolving market, the macro drivers matter more than short-term fluctuations.

That macro picture points to enormous potential. Baruah highlights that several mega-sized AI lab contracts (each potentially worth more than $500 billion) are now being contested within the Neocloud arena. Since all the leading Neoclouds are expected to participate, CoreWeave looks almost certain to capture a share. In fact, Baruah suggests its revenue could eventually rival Google Cloud Platform’s, with the possibility of reaching ~$40 billion, supported by a backlog already near $30 billion.

With that outlook in mind, Baruah assigns CRWV shares a Buy rating and a $165 price target, implying 34% upside from current levels. (To watch Baruah’s track record, click here)

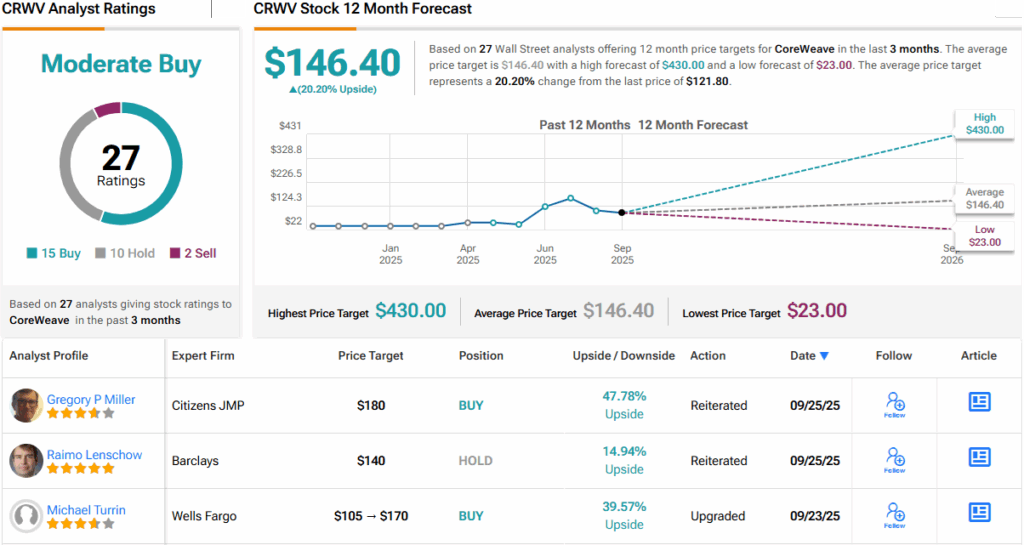

Taken together with Baruah’s view, the Street’s stance on CRWV includes 15 Buys, 10 Holds, and 2 Sells, culminating in a Moderate Buy consensus rating. Based on the $146.40 average price target, the shares are projected to rise 20% in the months ahead. (See CRWV stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.