It was somewhat of a backhanded praise that Apple (NASDAQ:APPL) took from Wedbush Securities recently. While the analyst offered up some very glowing praise, it also cut one of its key metrics around the stock. How do those two conditions exist together? You might be surprised. Apple was up on Friday’s trading but gave back some of those gains going into after-hours trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

First, the praise. Wedbush, via analyst Dan Ives, came out and declared that Apple was a “Rock of Gibraltar” stock that would manage to weather the storm in the tech sector. That’s thanks mainly to the hefty number of users that Apple already has on hand. That walled garden means quite a bit of cash flow as users buy new apps and new content. Not all of them will slow down at once, either, so Apple can be reasonably assured of cash flow for the foreseeable future.

However, Apple will also have its share of troubles. Sufficient troubles, in fact, to prompt Ives to cut Apple’s price target to $175 per share, down from its original $200. The rating of “outperform” was left in place, though. Ives points out that tech demand is likely a bit more resilient than tech bears forecast. But Apple will also have troubles stemming from a faltering macroeconomic environment and a mangled supply chain. Apple has even engaged in corporate layoffs, which suggests at least some troubles afoot.

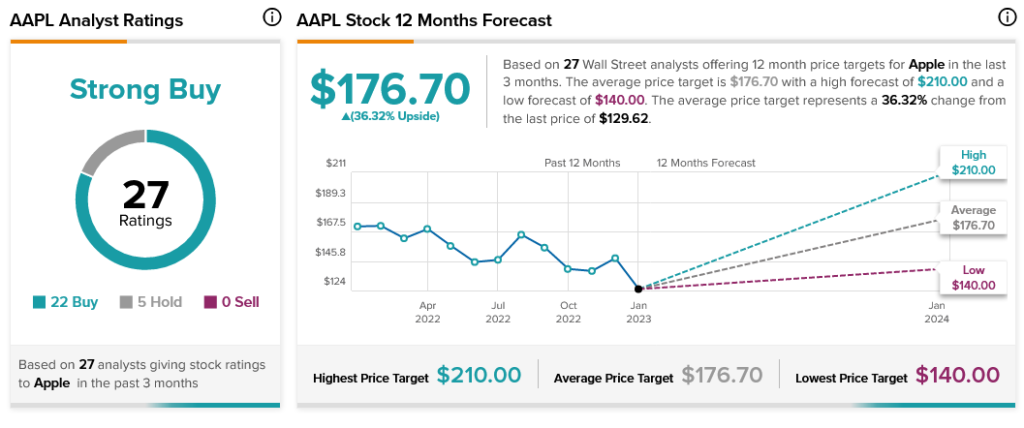

Despite all this, Wall Street remains squarely in Apple’s corner. Apple shares are considered a Strong Buy by analyst consensus. Said shares also offer 36.32% upside potential by virtue of a $176.70 average price target.