Used-car retailer CarMax (KMX) failed to impress investors and analysts after releasing disappointing Q2 FY26 results. Notably, Wedbush’s top analyst, Scott Devitt, downgraded KMX stock to Hold and cut the price target by 35% to $54. Devitt cited “weak” results and doubts about CarMax’s future market leadership as reasons for the downgrade.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

KMX stock dropped 20% on Friday after Q2 earnings and revenue missed estimates. The shares have also declined 44% year-to-date.

Wedbush Turns Cautious on CarMax

Devitt noted that CarMax missed expectations on “all key metrics,” including revenue, retail sales, and diluted EPS. He also highlighted disappointing results in used-car unit growth, average selling price, and retail gross profit, all of which fell short of estimates.

As a result, Devitt said that the weak Q2 performance is raising investor concerns about the company’s ability to maintain market leadership and drive growth. He added that the overall outlook for CarMax has turned cautious, with the company now losing market share faster than its main competitor.

Devitt’s new price target of $54 implies an upside of 18.42% from the current level.

Wedbush Isn’t the Only One Downgrading KMX Stock

Following the results, Oppenheimer’s top-rated analyst Brian Nagel also downgraded his rating to Hold.

Nagel expressed concern that the company may need a longer-term strategic adjustment to strengthen its core offerings and improve marketing, especially as demand may weaken. He further noted that some of the recent sales and profit weakness might be short-term and self-inflicted, but these challenges still pose significant hurdles for the company.

Nagel added that he doesn’t expect CarMax shares to rise until there are clear signs of a lasting recovery.

Is CarMax a Good Stock to Buy?

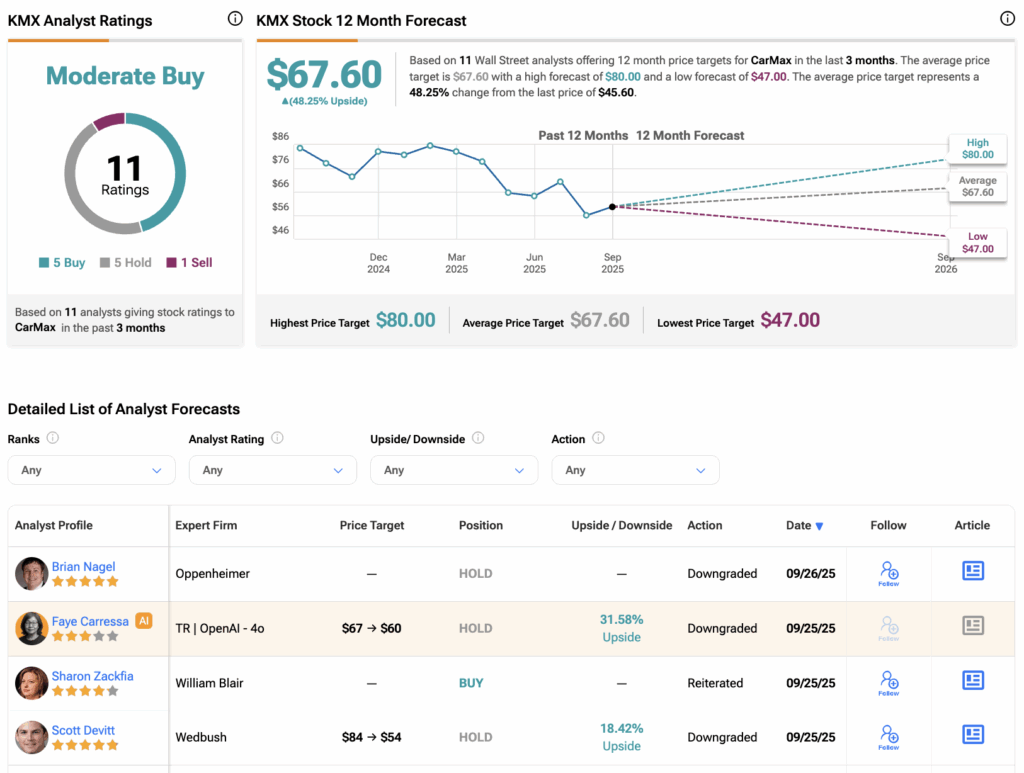

Turning to Wall Street, the analysts’ consensus rating for CarMax stock is Moderate Buy, based on five Buys, five Holds, and one Sell assigned over the past three months. Meanwhile, KMX stock price target of $67.60 implies a potential 48.25% upside for the shares.