Microsoft’s (MSFT) updated restructuring deal with OpenAI (PC:OPAIQ), which will see the U.S. tech heavyweight take a 27% stake in a for-profit corporation to be established to run the AI startup, has gained wide attention. However, it is essential to note that the government of California, where OpenAI is based, played a key role in clearing the path for the new arrangement.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

California Secures ‘Concessions’, Supports Recapitalization Plan

Reacting to the deal, Robert Bonta, California’s attorney general, said his office will continue to ensure that OpenAI remains committed to its public-benefit roots. OpenAI was founded in San Francisco in 2015 as a nonprofit research lab to ensure that artificial general intelligence benefits mankind.

“We will be keeping a close eye on OpenAI to ensure ongoing adherence to its charitable mission and the protection of the safety of all Californians,” Bonta said in a statement, adding that the public prosecutor’s office obtained “concessions” in that regard.

OpenAI has also pledged to remain in California, Bonta said. The Attorney General’s office had conducted over a year and a half of “robust investigation” into the first for-profit deal announced last month and the latest revised version.

Bonta also pledged that his office “will not be in court opposing OpenAI’s recapitalization plan” so long as the concessions are in place. OpenAI’s new deal with Microsoft removes a key constraint on its fundraising ability. It also clears the path towards going public.

Wall Street Cheers Microsoft’s Deal with OpenAI

The new arrangement between Microsoft and OpenAI includes terms such as Microsoft committing $135 billion in investment, or a 27% stake, in OpenAI when it becomes a for-profit corporation. OpenAI will also purchase Microsoft’s Azure cloud services incrementally, up to $250 billion — which is crucial for the startup’s heavy AI workloads.

The deal has been praised by Wall Street analysts as highly beneficial for Microsoft, providing advantages such as boosting its Copilot initiative and unlocking additional monetization pathways in Azure and OpenAI. However, the Wall Street Journal reports that Microsoft’s disclosures about its OpenAI investments are “scant”, with $4.7 billion in OpenAI-related losses tucked under the tech company’s “other” expense line in its most recent fiscal year ended June 30th.

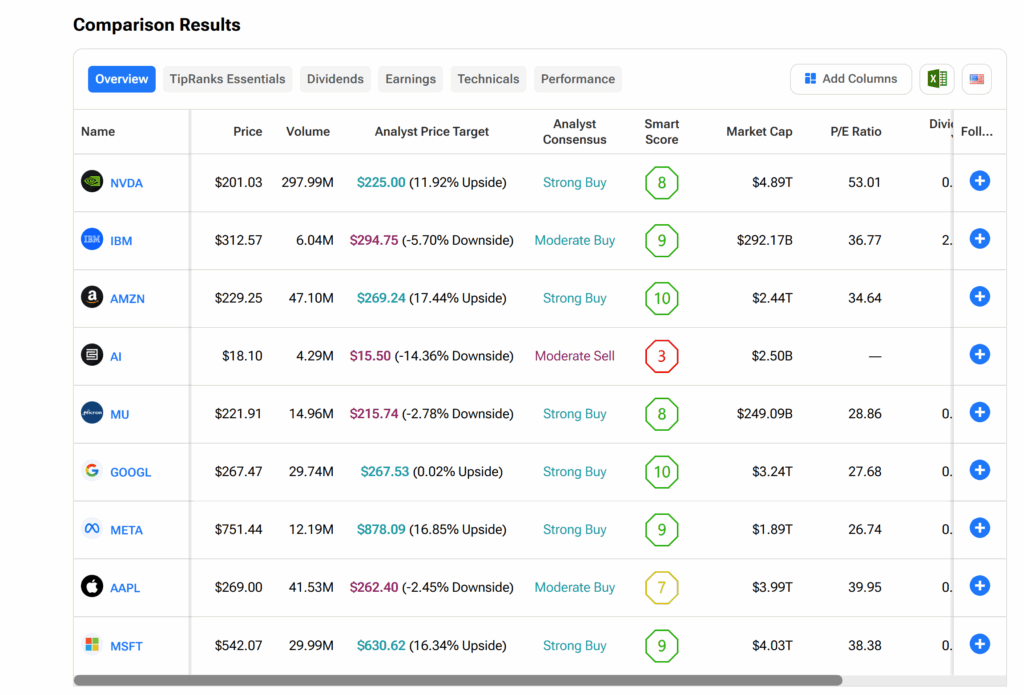

What Are the Best AI Stocks to Buy Now?

As the race to develop artificial intelligence intensifies, identifying the stocks that offer the best exposure and investment returns remains critical. TipRanks’ Stock Comparison tool provides guidance and insight in this regard based on Wall Street analysts’ estimates.

Kindly refer to the graphics below.