Shares of Warner Bros Discovery (NASDAQ:WBD) gained slightly in after-hours trading after the company reported earnings for its fourth quarter of Fiscal Year 2022. Earnings per share came in at -$0.86, which missed analysts’ consensus estimate of -$0.45 per share. Sales increased by 245.1% year-over-year, with revenue hitting $11.01 billion. This missed analysts’ expectations of $11.23 billion.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Warner Bros Discovery saw a fresh surge of direct-to-consumer (DTC) subscriptions, up 1.1 million to reach 96.1 million by the end of the fourth quarter. The biggest help there came as HBO Max got its restart on Amazon Channels back in December. Three Warner cable networks—TNT, TBS, and TLC—were in the top five networks for prime-time viewing among adults 25 to 54.

The Golden Globes proved fertile ground for Warner as well, with 22 nominations that resulted in eight wins. Studios posted $3.84 billion in revenue, down 25% from this time last year. Network revenue came in at $5.52 billion, down 9%, and DTC added $2.45 billion, down 50% year-over-year.

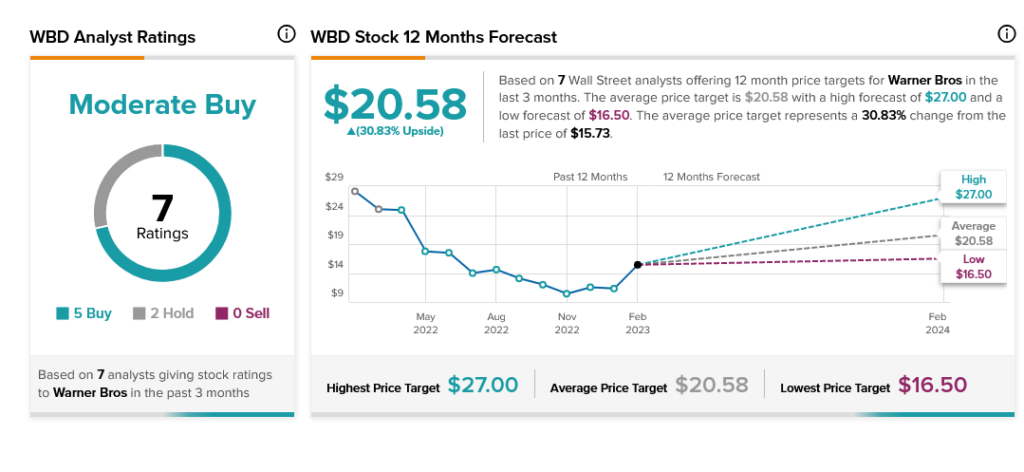

Overall, Wall Street has a consensus price target of $20.58 on Warner Bros Discovery, implying 30.83% upside potential, as indicated by the graphic above.