E-commerce company Wayfair (NYSE:W) rallied in pre-market trading after announcing that it would reduce its workforce by 13%. This layoff will likely impact 1,650 employees or 19% of its corporate team. Wayfair expects cost savings of over $280 million due to these layoffs.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company has projected these cost savings to substantially boost its profitability and now expects an Adjusted EBITDA of $600 million in 2024. Wayfair expects to incur employee severance and benefit costs of between $70 million and $80 million, most of which are likely to be expensed in the first quarter of this year. These expenses exclude non-cash charges associated with equity-based compensation.

Is Wayfair Stock a Good Buy?

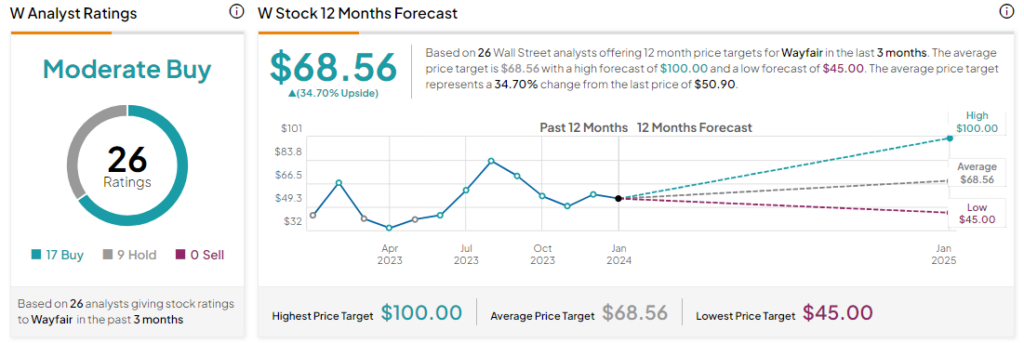

Analysts remain cautiously optimistic about Wayfair stock with a Moderate Buy consensus rating based on 17 Buys and nine Holds. Over the past year, Wayfair stock has gone up by 25%, and the average W price target of $68.56 implies an upside potential of 34.7% at current levels.