Wave Life Sciences (NASDAQ:WVE), a Singapore-based biotech firm, dropped a bombshell on Tuesday with news that it’s scrapping the development of its neurology drug WVE-004. This decision came on the heels of disappointing results from a Phase 1/2 trial for patients with amyotrophic lateral sclerosis (ALS) and dementia. Surprisingly, though, WVE stock is slightly higher at the time of writing following the announcement, recovering from its 27% pre-market plunge.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The trial, dubbed the FOCUS-C9 study, compared WVE-004 to a placebo in patients struggling with C9orf72-associated ALS and frontotemporal dementia. Participants were given either multiple 10 mg doses of WVE-004 or a placebo at different intervals over a 24-week period. Some were also given a single 20 mg dose.

Unfortunately, WVE-004 showed no clinical advantage, though it did reduce levels of Poly(GP), a biomarker linked to the disease. Despite this reduction, Wave confirmed there was no connection between lower Poly(GP) levels and improved patient outcomes. Consequently, without any reliable biomarkers that might forecast positive clinical outcomes, the company decided to pull the plug on WVE-004’s development.

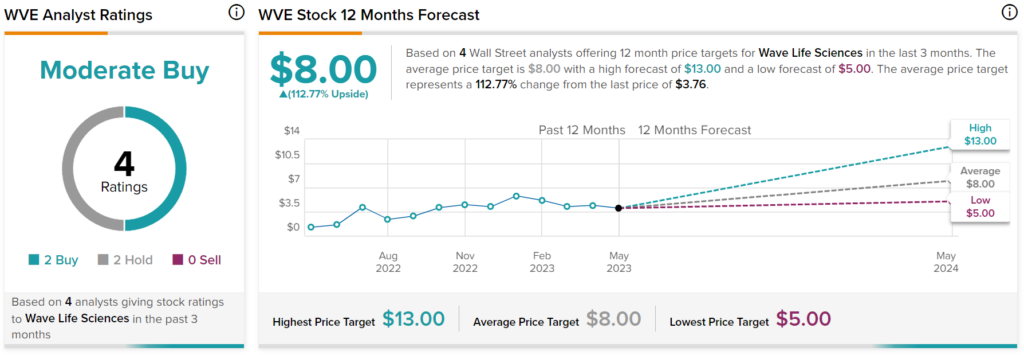

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WVE stock based on two Buys and two Holds assigned in the past three months. In addition, analysts anticipate the stock to double in share price.