When in the future the talk will turn to the 2024 bull run, the two letters that will come to represent the era will probably be AI. That will mostly likely be swiftly followed by a shout out to Nvidia (NASDAQ:NVDA). No other company has caught investors’ attention as much as the semi giant this year and for good reason.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nvidia shares have seen year-to-date gains of 138%, with 12-month returns soaring to 164%. These impressive numbers have propelled the chip maker from Mega Cap status to a contender for the title of the World’s Most Valuable Company. Unlike other high-flying stocks, Nvidia’s rise is built on a solid foundation. Essentially, due to the insatiable demand for all things GenAI, Nvidia has been reaping the rewards as the maker of the best AI chips out there.

So, it’s not as if the stock needs any help in gaining traction. Nevertheless, Citigroup’s Atif Malik, an analyst ranked at 10th spot amongst the thousands of Wall Street stock pros, thinks there’s a catalyst coming up that could push the shares even higher.

With the SIGGRAPH 2024 conference taking place between July 28 – August 1, the computer graphics and interactive techniques event merits the opening of a “positive catalyst watch.”

This is due to three reasons, says the 5-star analyst. For one, Nvidia CEO Jensen Huang and Meta CEO Mark Zuckerberg are expected to discuss the future of AI, and Malik thinks Nvidia might unveil the “much-anticipated” standalone Arm-Based Grace CPU for servers. Secondly, the CEO discussion is expected to highlight how Nvidia’s end customers generate revenue or their ROI profile, which is a “key topic on investors’ minds these days.” Lastly, Malik expects to hear “accelerating AI demand trend at the conference with no signs of an air pocket,” while the analyst considers the stock’s recent pullback due to geopolitical concerns as “a buying opportunity.”

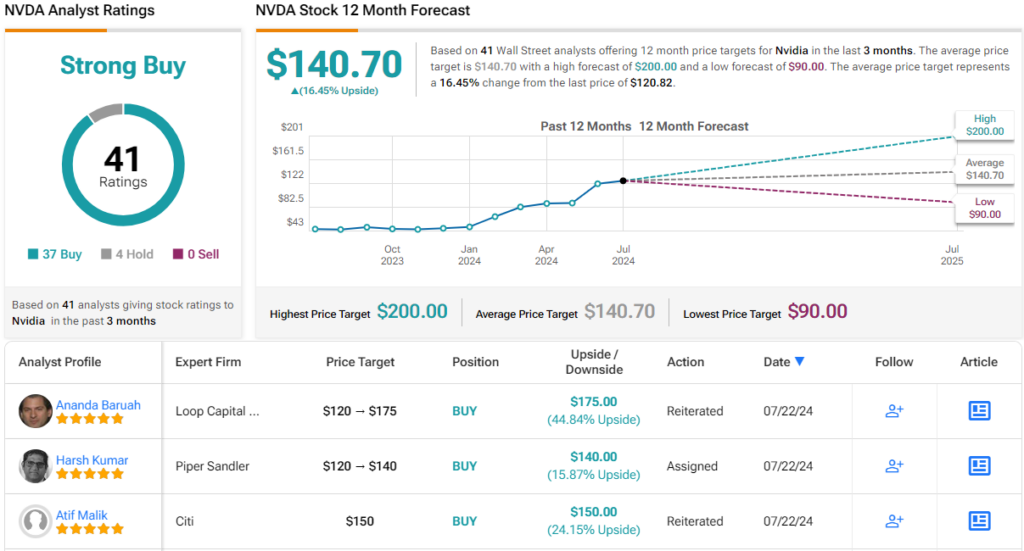

Near-term positive catalyst aside, Malik maintained a Buy rating on Nvidia shares, while his $150 price target factors in one-year returns of 24%. (To watch Malik’s track record, click here)

Nvidia also retains the support of most of Malik’s colleagues. Based on an additional 36 Buys plus 4 Holds, the analyst consensus rates the stock a Strong Buy. The average price target currently stands at $140.70, suggesting shares will gain ~16% in the months ahead. (See Nvidia stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.