Berkshire Hathaway ($BRB.B) is in talks to buy Occidental Petroleum’s (OXY) petrochemical business for about $10 billion, according to reports. If completed, it would be Warren Buffett’s biggest deal in years and a move that could help Occidental cut its heavy debt load.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Occidental has been working to bring its net debt down from roughly $22 billion to $15 billion. A sale of the chemical business would take it past this goal, while giving Buffett another piece of a company he already knows well.

Buffett Seizes on Depressed Valuations

The petrochemical business has been struggling with weak margins, just like Dow and LyondellBasell (LYB). Occidental projects that OxyChem will bring in about $850 million in pretax profits this year, well below the $1.1 billion earned in 2024 and the $1.5 billion in 2023.

Buffett’s strategy often centers on acquiring good businesses when earnings are down. Buying OxyChem now would give Berkshire exposure to a cyclical business at a price that looks attractive relative to its long-term potential. If the deal closes, it would be Berkshire’s largest since the $13 billion purchase of Alleghany in 2022.

Occidental Faces Pressure to Cut Debt

Occidental CEO Vicki Hollub has been under pressure to reduce the debt left over from its Anadarko acquisition in 2019 and the Crown Rock deal in 2024. The company has already paid down $7.5 billion over the past year through asset sales and cash flow.

Selling the chemical unit would allow Occidental to go beyond its $15 billion debt-reduction target, years ahead of schedule. This would strengthen the balance sheet and ease concerns about the preferred stock deal struck with Berkshire in 2019, which costs Occidental more than $600 million a year in dividends.

Analysts Question the Sale

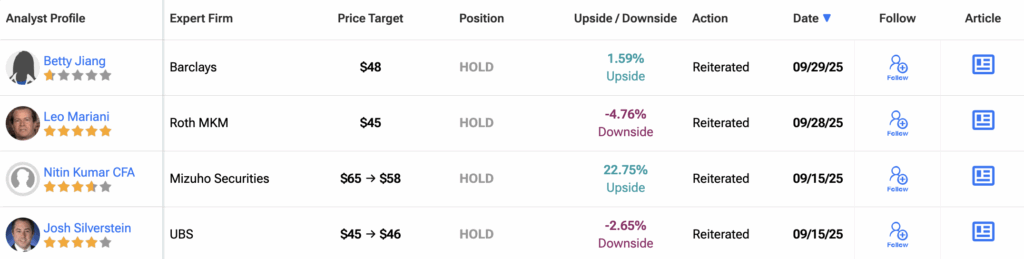

Not everyone thinks the sale makes sense for Occidental. Roth Capital analyst Leo Mariani said that OxyChem represents a diversification asset that most exploration and production peers do not have. He also pointed out that the $10 billion price tag equates to roughly eight times trough earnings, which may undervalue the business if margins recover.

Still, the debt overhang has limited Occidental’s ability to repurchase shares and invest for growth. A quick sale may give Hollub breathing room, even if the price looks light compared to future earnings potential.

Berkshire Strengthens its Hold on Occidental

Berkshire already owns a 27 percent equity stake in Occidental, worth about $12 billion, along with $8.5 billion of preferred stock and warrants to buy 84 million shares at just under $60. Adding OxyChem would deepen Buffett’s ties to the Houston-based energy group.

Berkshire investors may welcome the move. Buffett has been sitting on more than $330 billion in cash and has struggled to find large acquisitions. Deploying $10 billion into an asset tied to an existing portfolio company could be seen as a smart use of capital, especially at a time when the unit’s earnings are down.

What Could Happen Next?

Occidental has not confirmed whether it is pursuing a broad auction or simply negotiating directly with Berkshire. Buffett is known for avoiding competitive auctions and instead making simple take-it-or-leave-it offers. This approach worked in the Alleghany deal, which also turned out to include valuable hidden assets like the toy business behind Squishmallows.

For Occidental, the decision boils down to whether paying down debt faster is worth losing a diversified cash generator. For Berkshire, the chance to add another cash-flowing unit at a favorable price could be exactly the type of deal Buffett has been waiting for.

Is Occidental Petroleum a Good Stock to Buy?

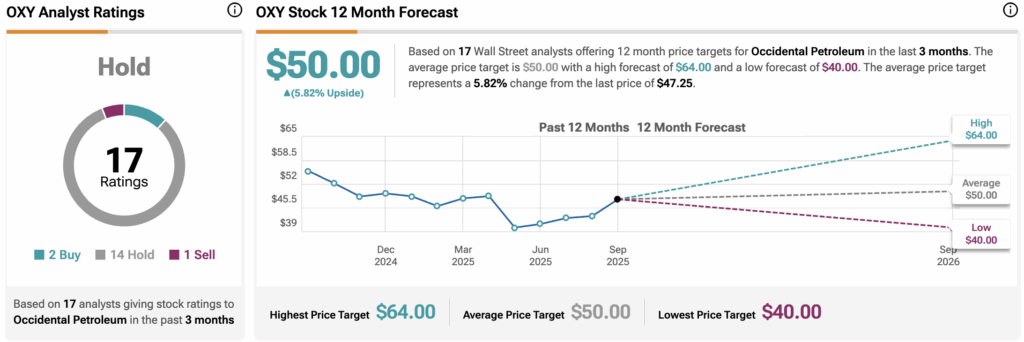

Wall Street remains cautious on Occidental stock, with the consensus rating at Hold. Out of 17 analysts who issued ratings in the past three months, 14 recommend a Hold, two suggest a Buy, and one advises to Sell.

The average 12-month OXY price target stands at $50, just a 5.8 percent upside from the current price.