Those who follow gaming know that the release of “Suicide Squad: Kill the Justice League” was at least somewhat controversial. But the extent of that controversy—and what it cost Warner Bros Discovery (NASDAQ:WBD) in its gaming division—is something of a nightmare. So much so, in fact, that Warner is hiking prices in its streaming division to, in part, compensate. But investors are unbowed, as the media giant’s share prices increased modestly as a result.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The release of “Suicide Squad: Kill the Justice League” didn’t go very well at all. This came as a bit of a shock to Warner, who realized that the movies and the TV series spinoff, “Peacemaker,” did pretty well, all told. But the game fell as flat as a pancake and cost Warner about $200 million. As for what went wrong, reports varied, but a “constantly changing vision” was cited, along with frequent delays and a perceived political agenda that gamers found distasteful.

That $200 million crater in Warner’s books also came with another cost – the possibility of producer Rocksteady ending up shuttered as a result, though there’s nothing confirming that yet.

Have to Make It Up Somewhere…

At almost the same time this revelation emerged, news that Warner was hiking prices for its Max subscription service also emerged. Both monthly ad-free and premium monthly ad-free plans increased by $1, going to $16.99 and $20.99 per month, respectively. The annual ad-free rate is now $169.99, up $20, while the annual ad-free premium rate is now $209.99, up just $10. While official channels call it a response to the overall rising costs of delivering content, there’s no doubt that the $200 million hole in the revenue stream didn’t help matters.

Is Warner Bros Discovery a Good Stock to Buy?

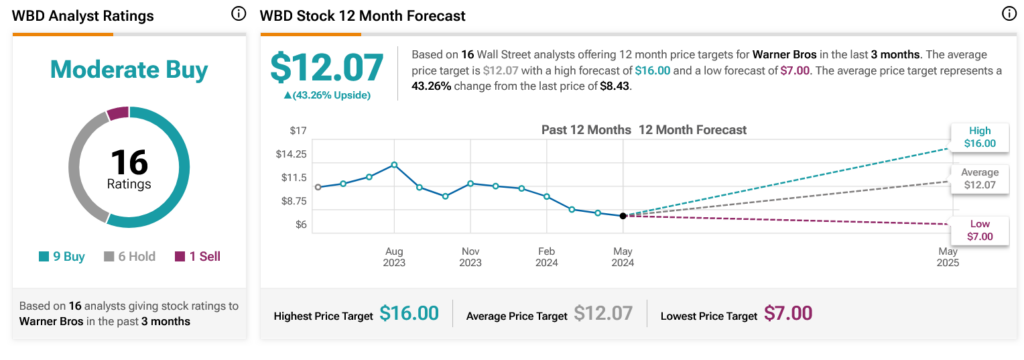

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on nine Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 35.94% loss in its share price over the past year, the average WBD price target of $12.07 per share implies 43.26% upside potential.