Retail giant Walmart’s (NYSE:WMT) Mexican subsidiary, Walmart de Mexico, or Walmex, is facing an antitrust hurdle. In connection with this issue, Walmex has disclosed the initiation of a quasi-jurisdictional administrative procedure against the company. This comes after a three-year probe prompted by accusations that Walmex was relatively involved in monopolistic behavior in the fields of supply, wholesale distribution, and marketing of consumer goods.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Per a Reuters report, Mexico’s antitrust authority, COFECE, voiced apprehensions over larger retailers imposing contractual terms and conditions on their suppliers in 2020. COFECE alleged that these practices placed smaller businesses in a challenging position and had the potential to impact their financial stability.

While Walmex has denied such allegations, it has a 45-day timeframe to submit its counterarguments and provide supporting evidence for its defense.

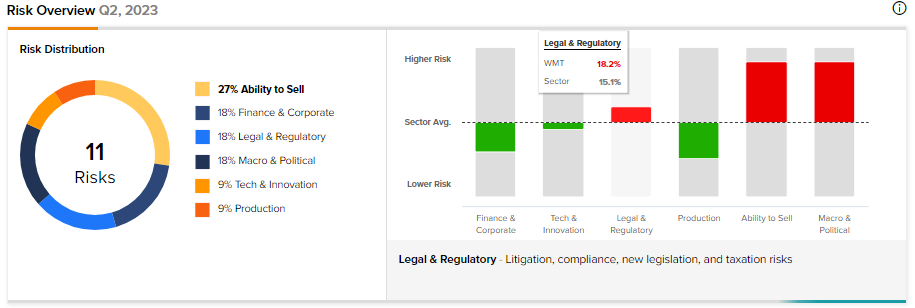

It’s important to highlight that Walmart operates in numerous countries and procures goods and services from several regions. Additionally, Walmart’s International operations accounted for roughly 17% of its total net sales in Fiscal 2023. Due to its extensive international activities, the company encounters various legal, regulatory, tax, and compliance-related risks. While the potential impact of this investigation on its finances and operations remains unclear, let’s look at Walmart’s risk profile.

Walmart’s Legal and Regulatory Risks Remain High

Antitrust investigations are not new for Walmart. Besides for Mexico, the retailer is also being scrutinized in Canada and India. These legal proceedings could result in regulatory actions, fines, and penalties that harm the business.

While the outcome of these risks remains uncertain, TipRanks’ risk analysis tool shows that Walmart’s legal and regulatory risks account for 18.2% of its total risks. At the same time, its legal and regulatory risk exposure is higher than the industry average. Further, its macro and political and ability to sell risks are significantly higher than the industry average.

Note that TipRanks’ Risk Analysis tool helps you to stay up-to-date with the changing risk scenario. As WMT has higher legal and regulatory risks, let’s look at what the Street projects for WMT stock.

What is the Future Outlook for Walmart Stock?

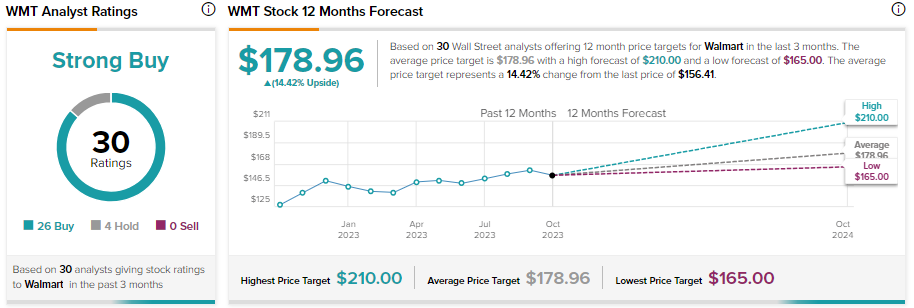

Wall Street analysts are bullish about Walmart’s prospects despite the heightened legal and regulatory risks. The company is focusing on improving efficiency, lowering unit costs, and driving earnings, which keeps analysts optimistic.

With 26 Buy and four Sell recommendations, WMT stock has a Strong Buy consensus rating on TipRanks. Analysts’ average price target of $178.96 implies 14.42% upside potential.