Walmart’s (WMT) recent announcement of price hikes due to escalating tariffs has stirred concern among consumers and investors alike. However, according to analyst Steven Shemesh at RBC Capital Markets, the move “shouldn’t have been surprising.” He added that tariffs are significantly high, and given that retailers already operate on thin margins, the impact is substantial. Shemesh kept his Buy rating on WMT stock with a price target of $102.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Notably, Walmart reported stronger-than-expected Q1 results, but the positive momentum was dampened by concerns over the impact of rising tariffs. The company stated that it faced rising import costs from tariffs in late April and May, prompting upcoming price hikes starting this month and continuing into June.

Top Analysts Keep Bullish Tone on WMT Stock

Following the results, five-star-rated analyst Paul Lejuez at Citi reiterated his Buy rating on WMT stock, saying the “Walmart winning” trend remains strong. His price target of $120 implies an upside of 25% from current levels.

Lejuez said Walmart’s Q1 results were slightly better than high expectations, especially due to strong sales in April and early May. However, it’s still unclear how customers will respond to price increases, though that’s a common concern across the retail industry. Meanwhile, Justin McAuliffe, research analyst at Gabelli Funds, stated that if Walmart is raising prices, it’s a clear signal that other retailers will likely follow suit.

Even so, Lejuez noted that Walmart is well-positioned to handle challenges like tariffs and broader economic uncertainty, thanks to its massive buying power, strong value reputation, and fast-growing, high-margin business segments.

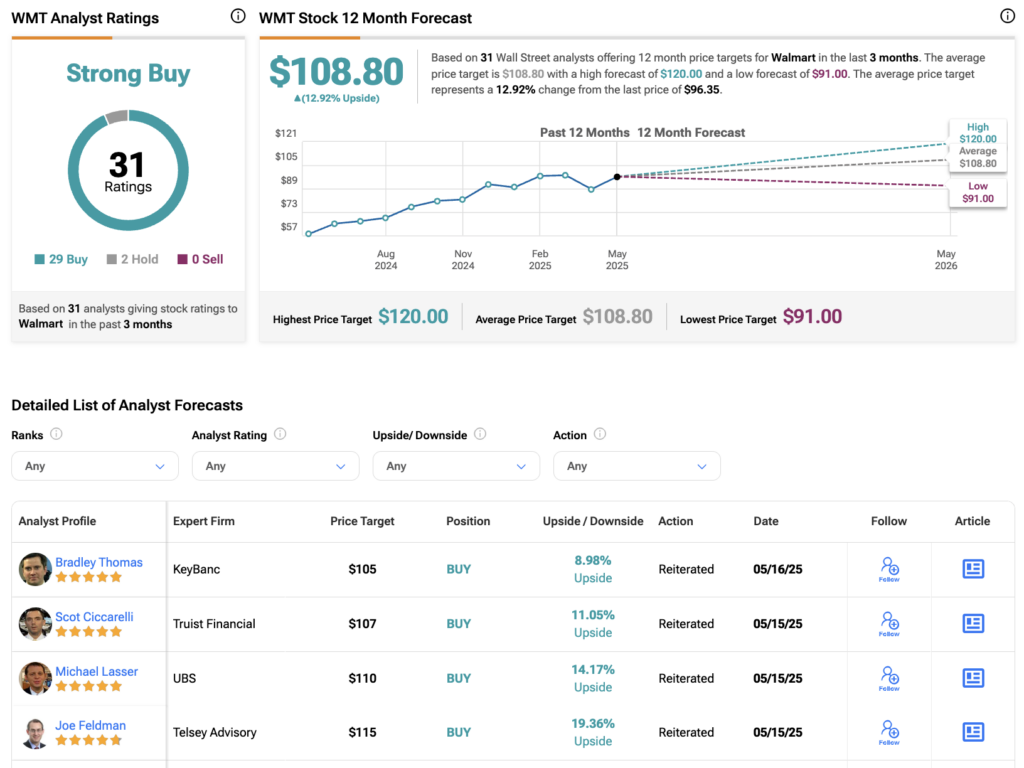

On Wall Street, several other top analysts from firms like KeyBanc, Truist Financial, UBS, and Goldman Sachs reiterated their Buy ratings on WMT stock. However, most stopped short of raising their price targets amid ongoing tariff pressures and macroeconomic headwinds.

Is Walmart a Good Stock to Buy Right Now?

According to TipRanks, Wall Street has a Strong Buy consensus rating on WMT stock, based on 29 Buys and two Holds assigned in the last three months. The average Walmart stock price target of $108.80 implies 12.3% upside potential.