Walmart (NYSE:WMT) continues to rejig its global operations in an effort to pursue long-term, sustainable, and profitable growth. In the latest move, the world’s largest retailer has invested $1.4 billion to increase its stake in its majority-owned India-based subsidiary Flipkart, according to a Wall Street Journal report.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Per the report, Walmart has paid $1.4 billion to buy Tiger Global’s ownership stake in the Indian e-commerce giant. The move will further strengthen WMT’s control over Flipkart, enabling the company to benefit from the fast-growing consumer market in India.

WMT initially picked up a 77% stake in Flipkart in 2018 for $16 billion. Later, it increased its holdings to 83%. However, during Fiscal 2022, WMT received $3.2 billion in new equity funding for its majority stake in Flipkart, which lowered its ownership to approximately 75%.

As Walmart reorganizes its international portfolio, let’s check the company’s divestitures and acquisitions in the past three years.

Walmart Reshapes International Portfolio

To drive profitable growth, Walmart continues to reshape its international portfolio. In the last three years, WMT has divested its operations in Argentina. Further, it completed the sale of ASDA, its retail operations in the U.K. Moreover, it sold the majority stake in Seiyu, its retail operations in Japan.

Apart from these initiatives, the company increased its ownership in PhonePe, the digital transaction platform in India, as part of PhonePe’s separation from Flipkart in December 2022.

While WMT is taking measures to deliver sustainable and profitable growth, let’s understand what Wall Street analysts recommend for its stock.

Is Walmart a Good Stock to Buy?

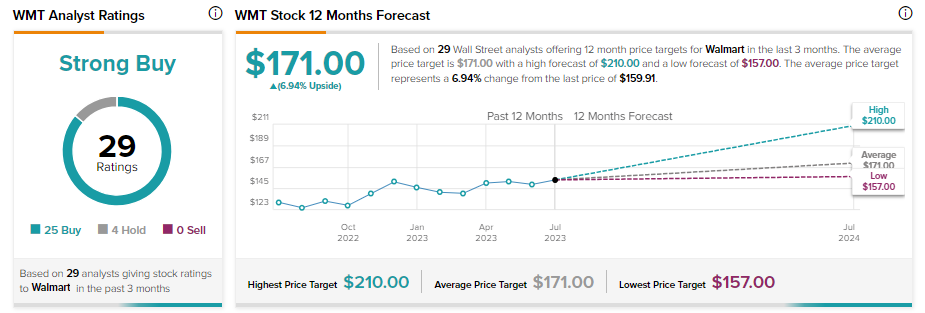

Walmart stock has a Strong Buy consensus rating based on 25 Buy and four Hold recommendations. Earlier, on July 24, Piper Sandler analyst Edward Yruma upgraded WMT stock to Buy, citing the easing of grocery inflation. The analyst expects WMT to gain market share, which will drive its financials.

Overall, analysts recommend an average price target of $171 on WMT stock, implying 6.94% upside potential from current levels.