Normally, the news that a business is about to pay out a multi-billion dollar settlement would not be cause for cheers from investors. For Walmart (NYSE:WMT), though, it’s a different story. Walmart notched up slightly in afternoon trading after reports emerged that it’s passed the first hurdle in settling with states over its part in the opioid epidemic.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Reports note that Walmart has reached agreements with all 50 states, though the amounts of the settlement involved vary with each state. However, we know the total amount involved. Walmart will ultimately shell out $3.1 billion across all 50 states. Additionally, amounts will go to the District of Columbia, three separate U.S. territories, and Puerto Rico.

In order for the settlement to go through, 43 states needed to join the settlement by December 15. That milestone passed, and then some. Additionally, under the terms of the settlement, Walmart need not admit to any sort of wrongdoing or liability in the matter. It also maintains that the allegations against it are wrong. Walmart will also be getting off somewhat lightly in the matter as well. Previous settlements from Walgreens (NASDAQ:WBA) and CVS Health (NYSE:CVS) came in at around $5 billion apiece.

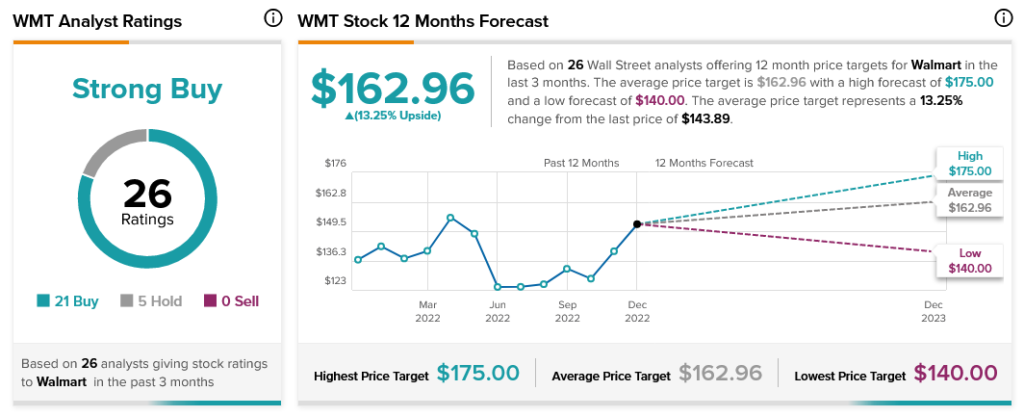

Regardless of the amounts, Walmart shareholders just seem to be glad it’s over. Or at least it will be before too much longer. Walmart remains a Strong Buy by analyst consensus. It has over four times the number of Buy recommendations that it has Holds. Additionally, the company has 13.25% upside potential by virtue of its average price target, $162.96 per share.