Most of the tech giants have now reported Q3 earnings, but there are still plenty of intriguing readouts on deck. Advanced Micro Devices (NASDAQ:AMD) will be one name sure to draw plenty of attention when it delivers Q3 earnings on Tuesday (November 4), having substantially improved its positioning in the AI game over the past few months.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As such, Susquehanna’s Christopher Rolland, an analyst ranked among the top 3% on Wall Street, thinks all eyes will be on the company’s AI accelerators – the current-generation MI350 and next-gen MI450 series.

“The magnitude of the MI350 ramp over [the] next 12 months and the longer-term MI450 opportunity remain the key debatable points,” said the 5-star analyst ahead of the print.

Segment-wise, for data center GPUs (50% of revenues), the MI350 series is anticipated to ramp sharply in the second half of this year. Although most investors already anticipate a strong 2H, the extent of any potential upside in DC/GPU performance is “difficult to identify” and remains a key debate point, with Rolland believing Q4 Street estimates are “beatable.”

Looking beyond 2025, investors are focused on AI growth, particularly following the OpenAI 6GW announcement, with the first gigawatt expected in 2H26. Rolland estimates roughly $15 billion per gigawatt, largely reflected in a 2H26 “uplift.” Additional catalysts such as Oracle’s planned AI supercluster using 50,000 MI450 GPUs starting in 3Q26, AMD’s new DOE supercomputer wins, and the HUMAIN partnership should “further layer on.” At the same time, management noted that the MI400 is “progressing well” for a 2026 launch, drawing “significant” interest from multiple clients.

Meanwhile, Rolland’s checks also point to solid performance for EPYC (data center CPUs) this quarter and continued strength ahead, driven mainly by market share gains and expanding enterprise adoption through OEMs such as Dell.

In the Client segment (25% of revs), the analyst believes tariff-related PC pull-ins continued past the first half of the year, as Q3 ODM builds came in stronger than expected. Intel also reported upside in its Client business during the quarter, likely helped by the same tariff-driven pull-ins. That said, AMD management had previously guided to a sub-seasonal 2H for Client, so Rolland models just 1% sequential growth in Q4. Rolland also notes that Susquehanna’s 2025 PC-Signals data suggests AMD lost share in laptop processors but gained share in desktops.

In the Embedded segment (15%), end-market demand is gradually recovering, though Rolland still sees some variability as certain channel inventories “remain elevated.” For the Gaming segment (10%), the PC-SIGnals data shows mixed trends. AMD lost a small share in the aftermarket graphics card market, though GPU pricing rose 3.3% quarter-over-quarter.

“In short,” the 5-star analyst summed up, “we generally expect slightly better results due to PC pull-ins, as well as a better 4Q driven by healthy server sales and general upside from MI350.”

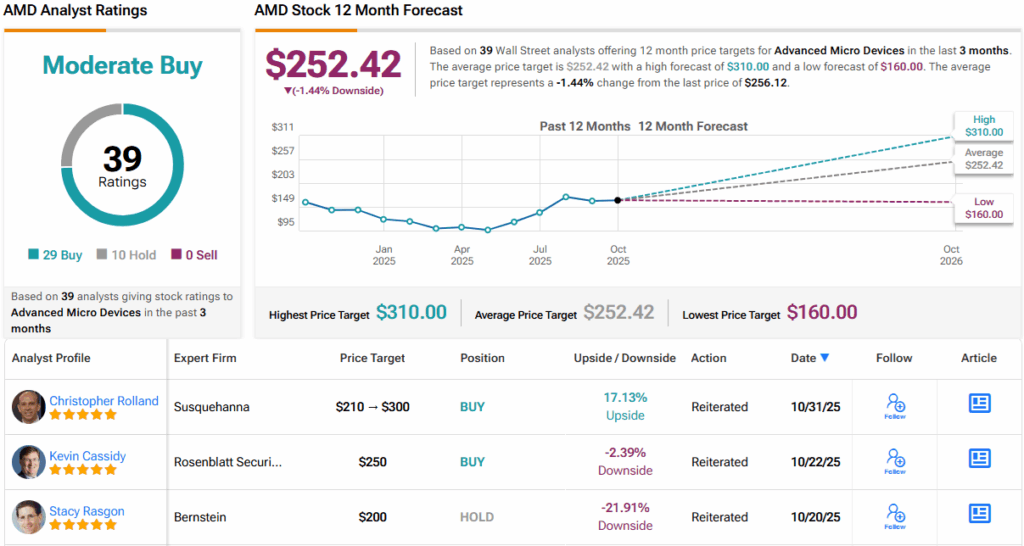

Bottom line, Rolland assigns a Positive (i.e., Buy) rating on AMD shares, while raising his price target from $210 to $300, suggesting the shares will gain 15% in the months ahead. (To watch Rolland’s track record, click here)

Elsewhere on the Street, 28 additional Buys and 10 Holds add up to a Moderate Buy consensus rating. Interestingly, the stock has already pushed past the $252.42 average price target. With earnings around the corner, investors will be keeping an eye on whether the Street refreshes its forecasts to catch up with the rally. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.