With a resurgent virus in the background, the stock market continues to remain volatile. TipRanks brings you the latest analyst action on some of your favorite stocks to sail smoothly through the market volatility. Let’s look into the noteworthy bullish and bearish calls of the day and see what the top Wall Street analysts are recommending.

Upgrades

1. Wayfair Inc

Stifel Nicolaus analyst Scott Devitt upgraded Wayfair (W) to Hold from Sell and increased the price target to $280 from $200 following the company’s 1Q results. Devitt commented, “We are largely maintaining our top line estimates through the balance of the year though raising our adj. EBITDA margin forecast over 100bp as the cost structure now supports a stronger than previously expected margin profile (given the deceleration as the company lapped more challenging compares).” Furthermore, the analyst added, “Our long-term outlook reflects the stronger profitability trajectory driven by recent investments in supply chain efficiencies and supplier services as well as better wholesale economics.”

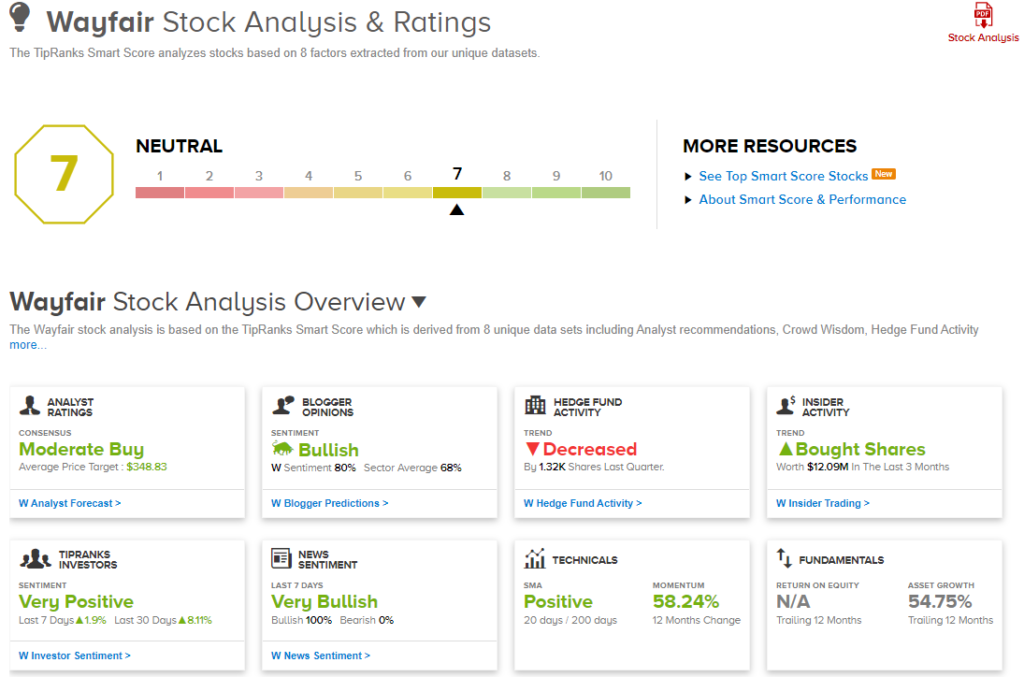

According to TipRanks’ Smart Score system, Wayfair gets a 7 out of 10, which indicates that the stock is likely to perform in line with market averages.

2. Shift4 Payments

Wolfe Research analyst Darrin Peller upgraded Shift4 Payments (FOUR) to Buy from Hold following the company’s 1Q earnings report.

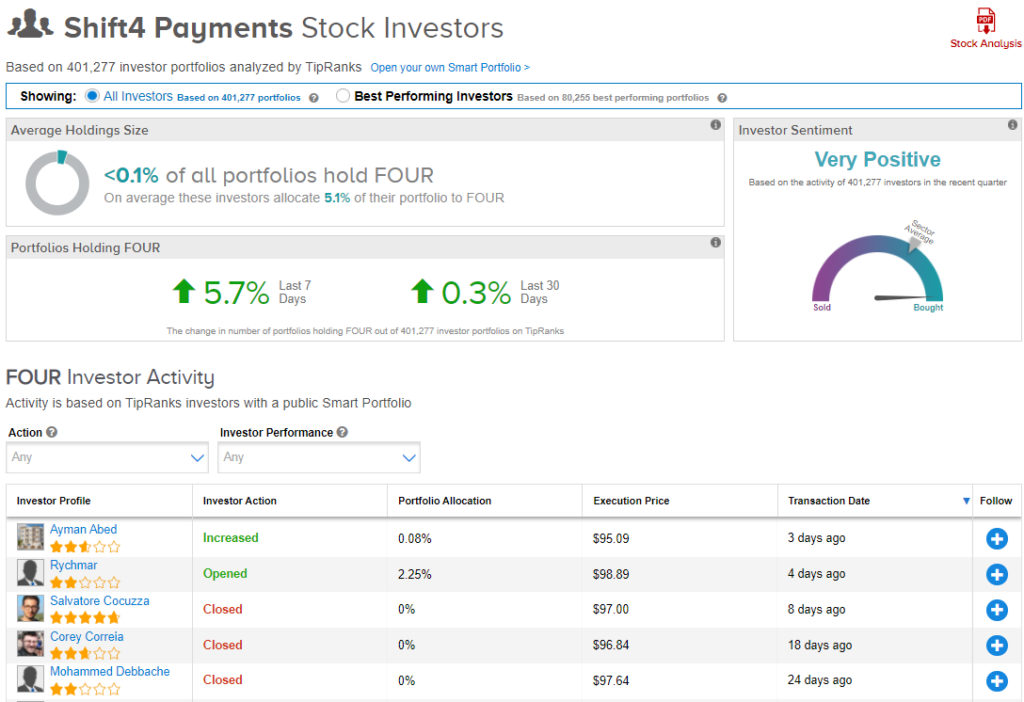

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Shift4 Payments, with 5.7% of investors increasing their exposure to FOUR stock over the past seven days.

3. Flex Ltd

Cross Research analyst Shannon Cross upgraded Flex (FLEX) to Buy from Hold and maintained a price target of $22 following the company’s “strong” fiscal 4Q results. Cross believes that Flex is well-positioned to gain from margin expansion, which is likely to be supported by an improving mix and better execution driving earnings growth and multiple expansion. Furthermore, the analyst also believes that through Nextracker’s initial public offering, Flex will be able to roll up Nextracker’s higher margin revenue and provide investors with “significant visibility” into the asset to monetize ownership over the coming period.

Consensus among analysts is a Strong Buy based on 5 Buys versus 1 Hold. The average analyst price target stands at $25.25 and implies upside potential of 38.5% to current levels.

4. Russel Metals Inc

TD Securities analyst Michael Tupholme upgraded Russel Metals (RUSMF) to Buy from Hold and increased the price target to C$37 from C$26 following the company’s “very strong” 1Q results. Tupholme views the gains from Russel’s OCTG and line pipe business rationalization as positive and believes that the company is attractively valued at current levels.

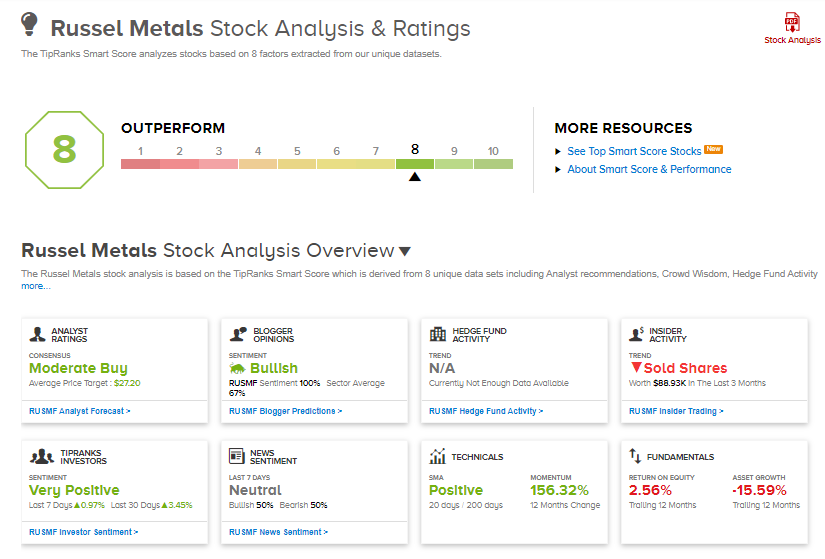

Russel Metals scores an 8 of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

5. Accolade

Leerink Partners analyst Stephanie Davis upgraded Accolade (ACCD) to Buy from Hold and maintained a price target of $56. Davis believes that COVID headwinds have mostly subsided and Accolade reflects a higher growth end market with its new virtual care acquisitions. Furthermore, he added that the stock has gained just 4% so far this year.

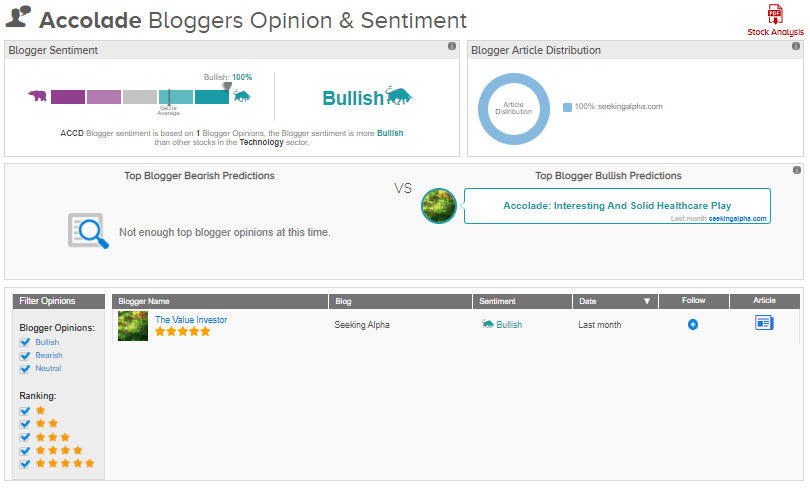

TipRanks data shows that financial blogger opinions are 100% Bullish on ACCD, compared to a sector average of 67%.

Downgrades

1. VEREIT, Inc.

BMO Capital analyst Frank Lee downgraded VEREIT (VER) to Hold from Buy but increased the price target to $48 from $45. According to Lee, the company’s merger with Realty Income is likely to close in the fourth quarter, and “there is a low probability for a competing bid”.

TipRanks’ Stock Investors tool shows that investors currently have a Very Negative stance on VEREIT, with 10.1% of investors decreasing their exposure to VER stock over the past 30 days.

2. ChemoCentryx, Inc.

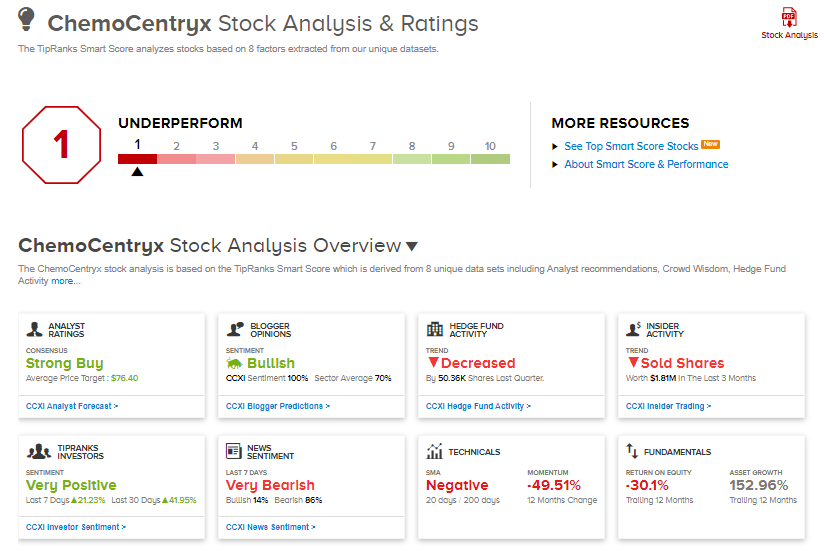

Piper Sandler analyst Edward Tenthoff downgraded ChemoCentryx (CCXI) to Hold from Buy and decreased the price target to $25 from $80 following the FDA Arthritis Advisory Committee’s (ADCOM) voting results on whether the efficacy data is adequate to support the approval of avacopan or not. Tenthoff believes that the AdComm vote will not be sufficient to receive the FDA’s approval for the treatment by the July 7 PDUFA.

ChemoCentryx gets a 1 out of 10 on TipRanks’ Smart Score ranking suggesting that it is likely to underperform market expectations.

3. Klepierre

Societe Generale analyst Ben Richford downgraded Klepierre (KLPEF) to Sell from Buy but increased the price target to EUR 19.80 from EUR 17.90. Richford remains cautious on offices due to rising vacancy rates, which is increasing the pricing power of tenants.

Despite the downgrade, the stock has a Hold consensus rating based on 3 Buys, 2 Holds, and 2 Sells. The average analyst price target of $26.02 implies 3.7% downside potential from current levels.

4. Pioneer Natural

Truist Financial analyst Neal Dingmann downgraded Pioneer Natural (PXD) to Hold from Buy and maintained a price target of $190 citing the “fear of change” in the “ever-changing energy investor appetite”. Though Dingmann considers the company’s long-term metrics to be favorable, he said that 1Q earnings results were “mixed”, including various one-off financial items related to the company’s acquisition of Parsley and winter storm, Uri.

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Pioneer Natural is currently Neutral, as 10 hedge funds decreased their cumulative holdings of the stock by 161,800 shares in the last quarter.

5. OceanFirst Financial Corp.

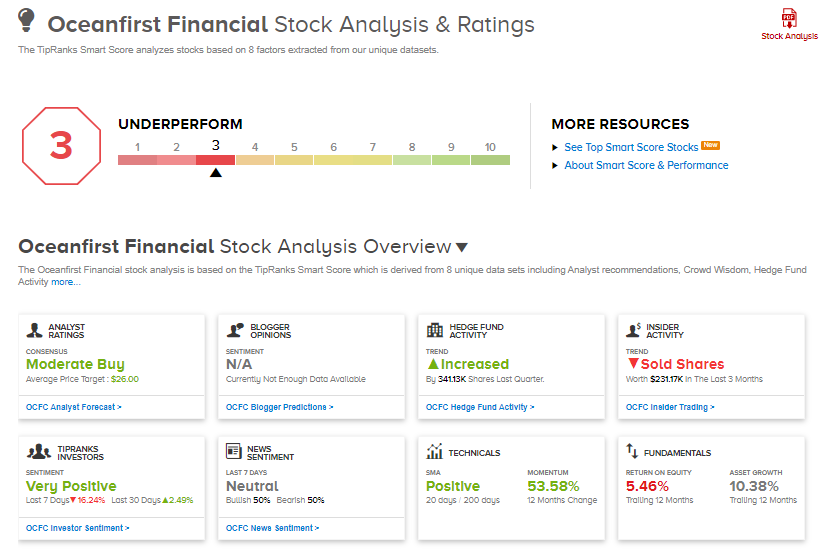

Stephens analyst Matthew Breese downgraded OceanFirst Financial (OCFC) to Hold from Buy and decreased the price target to $24 from $25.50. In a note to investors, Breese said that though balance sheet restructuring which occurred in 4Q was expected to result in net interest margin (NIM) expansion of 15 basis points, NIM disappointed in 1Q and the “pathway to a 1.00% ROA appears beyond 2022”.

OceanFirst gets a 3 out of 10 on TipRanks’ Smart Score ranking suggesting that it is likely to underperform market expectations.

Besides the above, you can also have a look at the following:

Are the Wheels Coming off for Peloton? Analyst Weighs In

Pfizer Stock Looks Healthy At Current Levels

Analysts Bank On These 3 Fintech Stocks

Dividend-Yield Calculator