U.S.-based mobile tech company AppLovin (APP) stock has recently faced a selloff amid concerns over a data probe. Despite the short-term headwinds, Wall Street analysts remain confident in the company’s growth prospects, driven by AppLovin’s dominant position in mobile advertising and app monetization.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Put simply, AppLovin provides AI-powered solutions designed to help companies expand their advertising reach. APP stock crashed around 14% on Monday after investors reacted to a Bloomberg report that the SEC is investigating the company’s data-collection practices. The probe is examining whether AppLovin violated regulations related to targeted advertising, according to the report.

Later, AppLovin’s stock rebounded, rising 7.64% in Tuesday’s session. Year-to-date, the stock has surged over 95%.

Oppenheimer Stays Bullish on APP Stock

Yesterday, Oppenheimer’s five-star-rated analyst Martin Yang reiterated his Buy rating on APP stock, predicting an upside of 17%.

Yang noted that the investigation reportedly stems from a whistleblower complaint filed earlier this year, as well as recent short-seller reports. By reviewing SEC FOIA logs, he identified four additional open requests on AppLovin, all made by Bloomberg. Yang remains cautious that these developments could drive near-term volatility in the stock. However, his long-term bullish thesis remains intact.

AppLovin Selloff Is a Buying Opportunity, According to Citi

Citi’s five-star analyst Jason Bazinet recommends buying AppLovin shares following the recent pullback, which he describes as “a bit extreme.” He estimates the decline reflects a $680 million revenue hit, which he considers overstated and an exaggerated assumption compared to the actual risk.

Bazinet, who maintains a Buy rating and $850 price target on APP, noted that the company’s response to the SEC report suggests management does not view the issue as materially serious. He added that any weakness in APP stock is a buying opportunity.

Is AppLovin Stock a Good Buy?

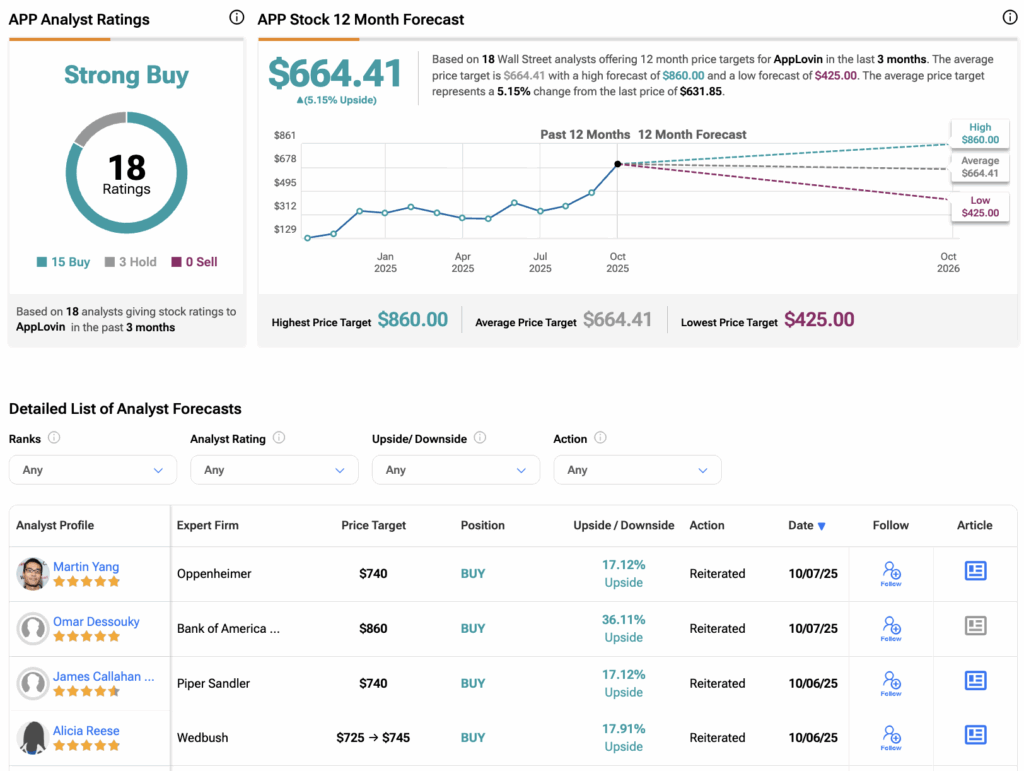

According to TipRanks, APP stock has received a Strong Buy consensus rating based on 15 Buys and three Holds assigned in the last three months. The average price target for AppLovin is $664.41, suggesting an upside of 5.15% from its current price.