Walgreens Boots Alliance (NASDAQ:WBA) disclosed that the Internal Revenue Service (IRS) is seeking $2.7 billion in unpaid taxes from the company regarding a transfer pricing matter. After this disclosure, shares of the retail pharmacy chain operator closed about 10% lower on Monday, April 1. However, TD Cowen analyst Charles Rhyee views the market’s reaction as “overblown.”

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Rhyee reiterated a Buy rating on WBA stock on April 1. Further, his price target of $37 implies 89.36% upside potential from current levels. The company’s management assured the analyst that their valuation methods align with U.S. GAAP and the Federal Income Tax code. Additionally, they mentioned that reaching a final resolution could take several years.

The analyst believes that the large amount of unpaid taxes raises concern about the company’s ability to meet working capital needs and could disrupt its efforts to deleverage its balance sheet. However, Rhyee expressed confidence in WBA’s defense strategy and valuation method. Additionally, the analyst pointed out that since the final resolution is expected to take several years, WBA will have greater financial flexibility to address any challenges that may arise during this period.

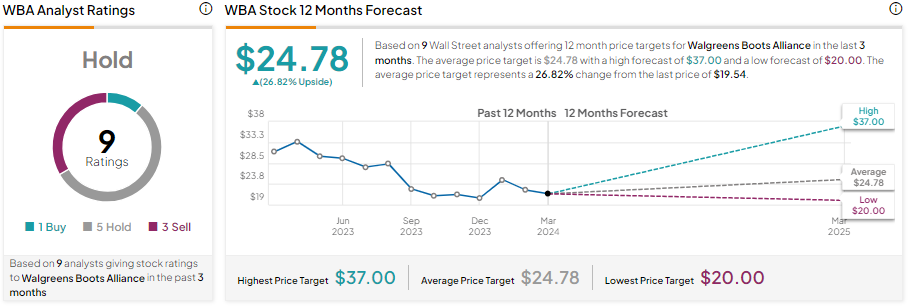

Is WBA a Buy, Sell, or Hold?

WBA stock is down about 41% in one year due to the tough retail environment in the U.S. Given the ongoing challenges, Wall Street analysts remain sidelined on WBA stock.

WBA stock has a Hold consensus rating, reflecting one Buy, five Hold, and three Sell recommendations. The analysts’ average price target on WBA stock of $24.78 implies a 26.82% upside potential.