Shares of retail pharmacy chain Walgreens Boots Alliance (NASDAQ:WBA) gained in pre-market trading after announcing its first-quarter results. This was despite an adjusted earnings decline of 43.1% year-over-year to $0.66 per share, as it still surpassed analysts’ estimates of $0.63 per share. The pharmacy chain’s first-quarter sales increased by 10% year-over-year to $36.7 billion and were above Street estimates of $34.88 billion. However, Walgreens Boots Alliance slashed its quarterly dividend by 48% to $0.25 per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Walgreens Boots Alliance’s CEO, Tim Wentworth, explained, “We are evaluating all strategic options to drive sustainable long-term shareholder value, focusing on swift actions to right-size costs and increase cash flow, with a balanced approach to capital allocation priorities.”

Looking forward, WBA reiterated FY24 adjusted earnings in the range of $3.20 to $3.50 per share, “with underlying earnings growth more than offset by lower sale and leaseback contribution, a higher tax rate, and lower COVID-19 contribution.” Furthermore, WBA expects its U.S. healthcare businesses to see an adjusted EBITDA in the range of -$50 million to $50 million.

Is WBA a Buy, Sell, or Hold?

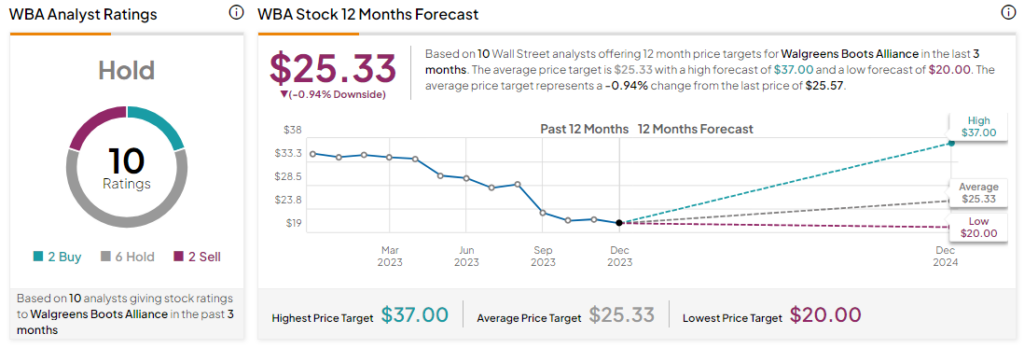

Analysts remain sidelined about WBA stock with a Hold consensus rating based on six Holds and two Buys and Sell each. Over the past year, WBA has slid by more than 20%, and the average WBA price target of $25.33 implies a downside potential of 0.9% at current levels.