Walgreens Boots Alliance (NASDAQ: WBA) stock was down in morning trading on Thursday even as the retail pharmacy chain’s fiscal Q1 results beat expectations. The company reported revenues of $33.4 billion, a decline of 1.5% year-over-year but beating consensus estimates by $340 million.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Adjusted earnings came in at $1.16 per share, a drop of 29.9% year-over-year on a constant currency basis versus analysts’ expectations of $1.14.

WBA raised its FY23 sales guidance to be in the range of $133.5 billion to $137.5 billion reflecting its acquisition of Summit Health. However, the pharmacy chain reiterated its adjusted earnings guidance to be between $4.45 and $4.65 per share as “strong core business growth is more than offset by lapping fiscal year 2022 COVID-19 execution, and currency headwinds.”

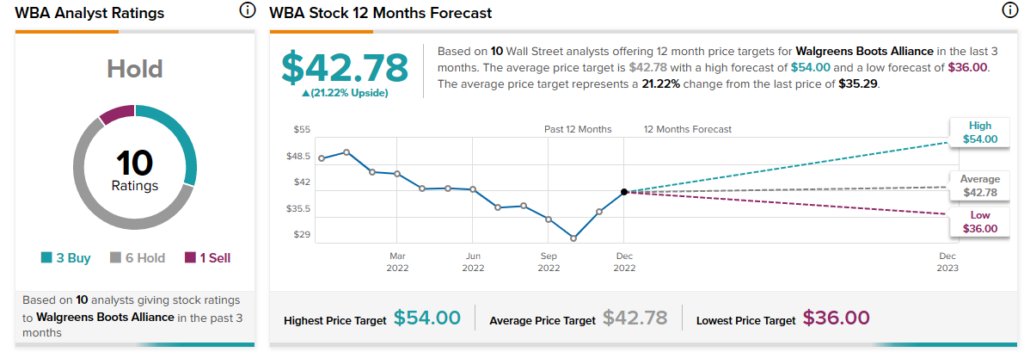

Analysts are sidelined about WBA stock with a Hold consensus rating based on three Buys, six Holds, and one Sell.