Will Walgreens Boots Alliance (NYSE:WBA) still be Walgreens Boots Alliance this time next year? Recent reports suggest that that may not be so, and investors aren’t exactly pleased about the whole thing. In fact, Walgreens shares are down fractionally in Tuesday afternoon’s trading as a result.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Boots isn’t a household name in some places, but it is in others, particularly in the UK, where it’s a widely-seen chain of drugstores. But the Walgreens Boots Alliance may be poised for a breakup, as Walgreens is looking into selling off the Boots chain. Reports indicate that the Boots chain is valued at around seven billion euros, roughly $8.8 billion, which could make it a very attractive buy for anyone who wants to augment their retail presence in the region. However, there may also be a separation in stocks, as Walgreens is also considering an initial public offering to spin it off that way.

Walgreens Boots Alliance is Troubled Internally

It could be said that Walgreens has bigger problems than what to do about Boots, but certainly, dropping Boots and taking the cash therein could be a help. After all, Walgreens has other issues on its plate, like its credit rating. Moody’s recently classified Walgreens’ senior unsecured credit rating as “junk,” which is not the place you want to be. Junk status generally requires outrageous interest rates to get investors’ interest, as it’s considered high risk.

Further, Walgreens is also having trouble with inventory shrink, particularly shoplifting. One former Walgreens manager noted that they “gave up caring about shoplifters” and that, if a thief ran out, management told employees to simply “carry on.” That’s not a sustainable long-term approach and one that Walgreens will need to address going forward.

Is Walgreens Stock a Buy, Sell, or Hold?

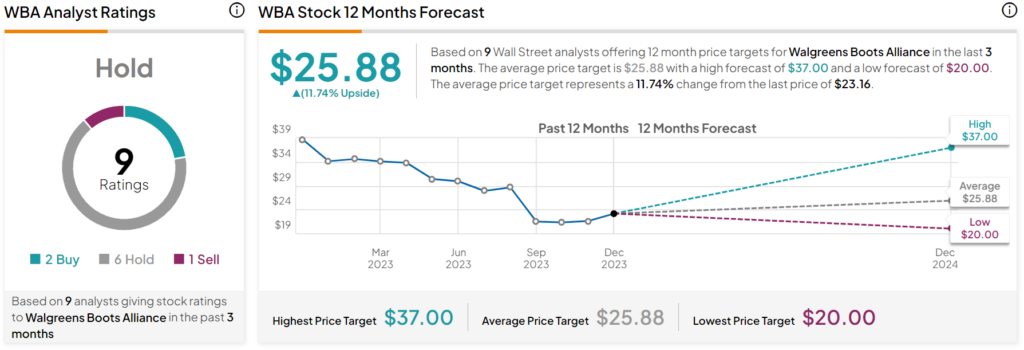

Turning to Wall Street, analysts have a Hold consensus rating on WBA stock based on two Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 40.44% loss in its share price over the past year, the average WBA price target of $25.88 per share implies 11.7% upside potential.