Walgreens Boots Alliance (NASDAQ: WBA) posted sales of $32.4 billion in the fourth quarter, down 5.3% year-over-year, but still coming in ahead of analysts’ estimates of $29.65 billion. The retail pharmacy chain’s adjusted earnings, however, declined 31.8% year-over-year to $0.8 per share in Q4 but surpassing Street estimates of $0.77.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Walgreens Boots Alliance’s CEO Rosalind Brewer stated, “Fiscal 2023 will be a year of accelerating core growth and rapidly scaling our U.S. Healthcare business. Our execution to date provides us visibility and confidence to increase the long-term outlook for our next growth engine and reconfirm our path to low-teens adjusted EPS growth. “

WBA expects FY23 adjusted earnings to come in between $4.45 and $4.65 per share. The company also raised the FY25 sales target for its U.S. healthcare business in the range of $11 billion to $12 billion and expects this segment to achieve positive adjusted EBITDA by FY24.

Is Walgreens Boots Alliance Stock a Buy, Sell, or Hold?

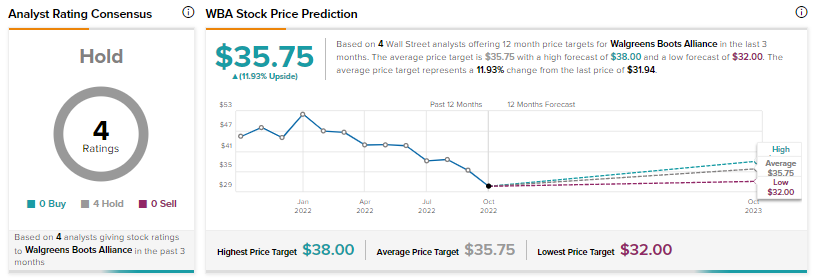

Analysts are sidelined about WBA with a Hold consensus rating based on a unanimous four Buys.

The average price target for WBA stock is $35.75 implying an upside potential of 11.9% at current levels.