It was hard to avoid the plaudits headed in Nvidia’s (NASDAQ:NVDA) direction following the semi giant’s by now almost customary beat-and-raise F4Q24 results. It was another display indicating its best-in-class AI chips remain in high demand and investors gave the thumbs up in big style. In fact, the $272 billion added to its market cap in the subsequent session represented the biggest one-day surge in stock market history.

Nvidia also remains confident demand will continue to grow beyond 2024, with the company expecting to see the benefits from the introduction of new products. That is a positive noted by Deutsche Bank’s Ross Seymore, an analyst ranked in the top 1% amongst Street experts. Seymore also points out that as the company continues to adhere to US export controls, China Data Center contribution in the quarter was “relatively minimal (fell to ~mid-single digit % from average 20-25%),” with the analyst now believing the “outlook for China going forward is relatively de-risked.”

Moreover, Nvidia’s cash position is also in great shape. FCF is reckoned to be at around ~50%+ of revenues, putting the company in a strong position to pursue “organic/inorganic growth initiatives as well as strong cash returns.”

So, basically the company can’t put a foot wrong. That said, while almost everyone on Wall Street is willing to fully embrace the hugely successful NVDA story, Seymore remains one of the very few skeptics out there. And that is just simply a valuation thing.

“Overall,” said the 5-star analyst, “we applaud NVDA for yet another quarter of massive upside on both the top and bottom line (NVDA operating income is expected to be as big/ bigger than INTC revenues going forward) and believe fundamental momentum remains in NVDA’s favor in the near and medium terms. However, on moderately higher estimates (higher revenues somewhat offset by a higher tax rate), and after embedding a modest cyclical correction in 2025, we believe NVDA’s earnings potential is sufficiently reflected in the co’s current valuation.”

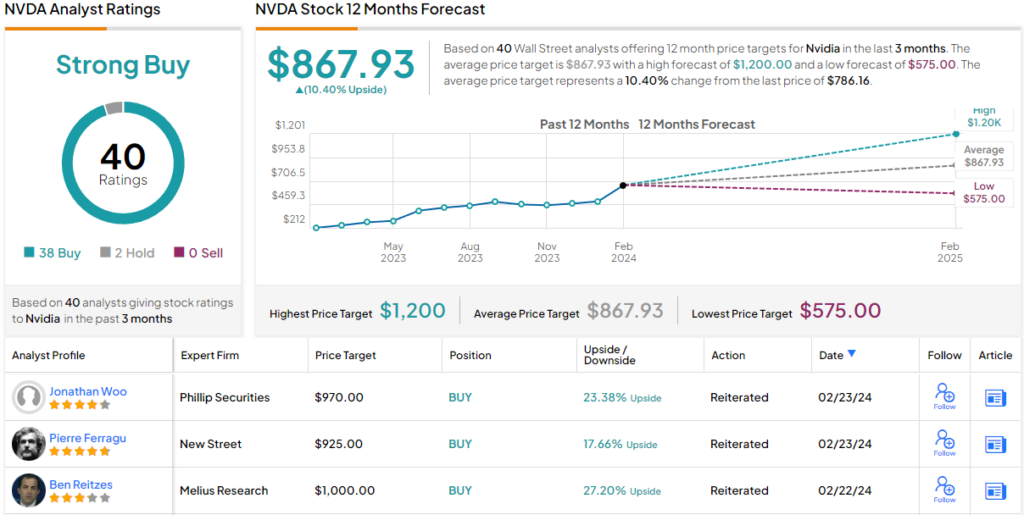

To this end, Seymore maintained a Hold (i.e., Neutral) rating on the shares, although the analyst raised his price target from $560 to $720. Nevertheless, that figure is still 8.5% below the current share price. (To watch Seymore’s track record, click here)

On the Street, one other analyst is willing to join Seymore on the fence, but they are thoroughly outnumbered by 38 positive reviews, all culminating in a Strong Buy consensus rating. The average target clocks in at $867.93, making room for additional gains of ~10% over the coming year. (See Nvidia stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.