Telecom giants Vodafone Group (GB:VOD) and CK Hutchison (FRA:2CK) announced that they are in talks for a potential merger of their businesses in Britain.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Vodafone will own most of the newly formed entity (51%), through a share exchange without any cash consideration.

As part of this deal, Vodafone UK will merge with Three UK and will have a customer base of 27 million.

This will take them ahead in the competition from BT Group’s (GB:BT.A) EE and Virgin Media’s O2.

With the merged business, both companies are aiming for a faster launch of 5G services along with increasing the reach of their broadband connectivity.

The news was not a surprise, as Vodafone’s chief executive earlier announced the company’s intention of looking for merger deals with its rivals in different markets in Europe.

The market reacted positively, and Vodafone shares were trading up by almost 3%.

Kester Mann, director of consumer and connectivity at CCS Insight, commented on the news, “The leading motivation to join forces is scale. In telecommunications, the most successful companies tend to be the largest; bulking up would offer many synergies and cost-saving opportunities. Under the status quo, it’s hard to see either operator growing enough organically to get close to challenging BT and Virgin Media O2 for size in the UK.”

Getting a green light from regulators could be a major challenge for both companies.

Authorities have earlier opposed the idea of reducing the number of companies in the telecom sector via such mergers.

Mann added, “Should any deal materialise, regulation would be a major hurdle. It would be up to the competition authorities to decide whether reducing the number of players is for the overall good of the market. Advocates will argue it encourages investment; dissenters will claim it’s a reason to push up prices.”

Is Vodafone Group a buy?

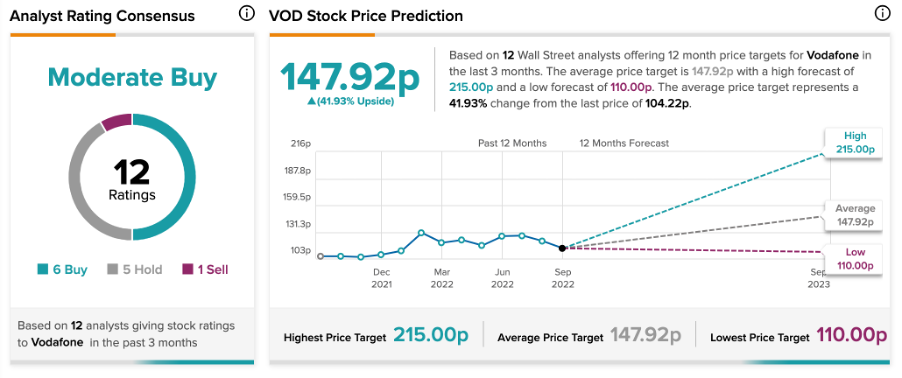

According to TipRanks’ analyst rating consensus, Vodafone Group stock has a Moderate Buy rating. This is based on ratings from 12 analysts, out of which six are Buys, five are Hold and one is a Sell recommendation.

The VOD target price is 147.92p, which shows an increase of 42% from the current price level.

Conclusion

Both companies hope to close the deal by the end of the year and are betting big on reaching a larger audience through the combined entity.