There’s big news afoot for chip stock Broadcom (NASDAQ:AVGO) as it moves to purchase cloud computing stock VMWare (NYSE:VMW). More specifically, word has emerged about China’s stance on the deal, and it was enough to send VMWare stock heading upward, while Broadcom stock pulled back fractionally in Wednesday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

China’s stance focused mainly on the deal’s relationship to China’s antitrust laws, and from the looks of it, the deal did not fare well. In fact, it didn’t fare well sufficiently that now, “remedy discussions” have been planned. Those should be starting up soon, and the State Administration for Market Regulation will have several key points requiring those remedies. The good news, however, is that preliminary remedies have already been discussed. Further word notes that the Chinese government is at least somewhat pleased with the remedies proposed.

This is good news for Broadcom, which wants the VMWare deal to go through and give Broadcom access to the growing cloud computing market. With analysts already expecting Broadcom revenue to increase nearly 8% for the year ending October 23, it’s going to need some catalysts to fuel that growth. Having access to VMWare’s customers, and being able to offer VMWare products to Broadcom’s own customer base, should be a big help in achieving that total.

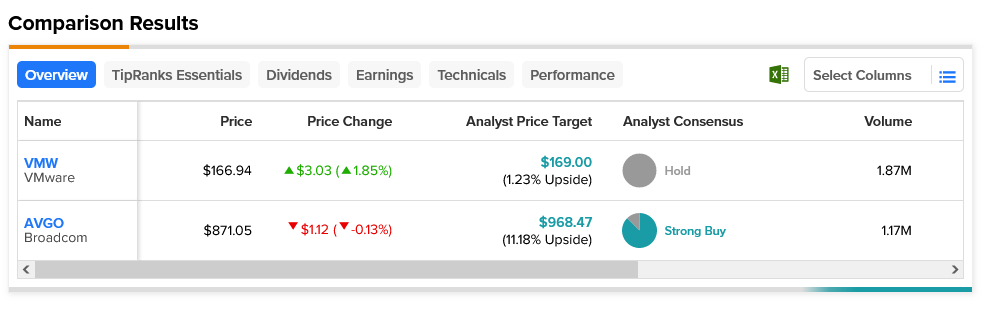

Broadcom leads the way here with analysts, coming in at a Strong Buy and offering 11.18% upside potential on an average price target of $968.47. Meanwhile, VMWare, a consensus Hold, offers 1.23% upside potential thanks to its average price target of $169.