Vistra (VST) surged 3.1% on Friday after announcing a massive $1.9 billion deal to supercharge its natural gas portfolio. The Texas-based energy company is snapping up seven power plants from Lotus Infrastructure Partners—an aggressive move aimed at meeting rising demand and securing its grip on the U.S. power grid.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Vistra Expands Natural Gas Muscle Across U.S.

The acquisition includes five combined cycle and two combustion turbine gas plants. These aren’t legacy relics either—they’re modern facilities with 2,600 megawatts of total capacity spread across both coasts.

Vistra’s CEO Jim Burke called the deal a “critical addition” to their national footprint, saying gas will be “key to the reliability, affordability, and flexibility” of the grid going forward. He’s betting big on gas just as the country braces for a summer of high heat and high consumption.

Vistra Adds to a Growing Energy Empire

Vistra already runs a mixed-energy empire spanning nuclear, coal, solar, and storage. This new purchase stacks on top of its 2018 Dynegy buy and the 2024 Energy Harbor acquisition—further cementing its all-of-the-above strategy.

The company will fund the deal with cash on hand and an existing term loan from Lotus. The transaction is expected to close by early 2026, pending regulatory approvals. Barclays and Moelis are advising on the deal.

VST Shares Bounce Despite Q1 Loss

Vistra’s stock popped despite posting a $268 million loss last quarter. While revenue rose year-over-year, costs and seasonal swings dented the bottom line. Still, the long-term view has investors holding steady. The VST stock is now up 14% in 2025 and 63% over the past year.

Is Vistra a Good Buy?

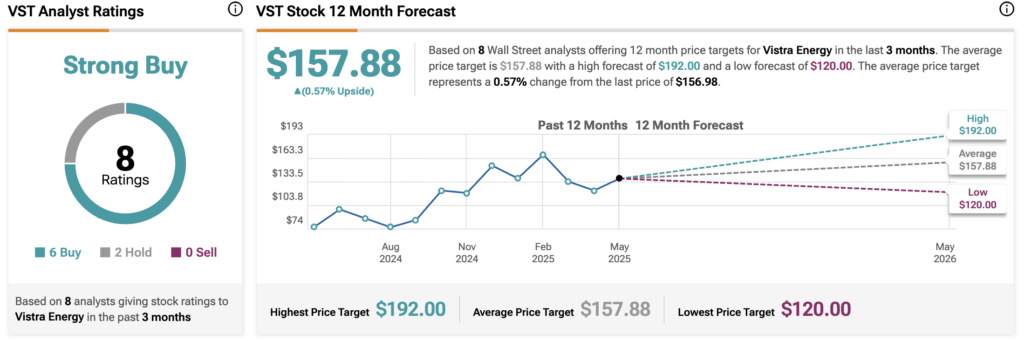

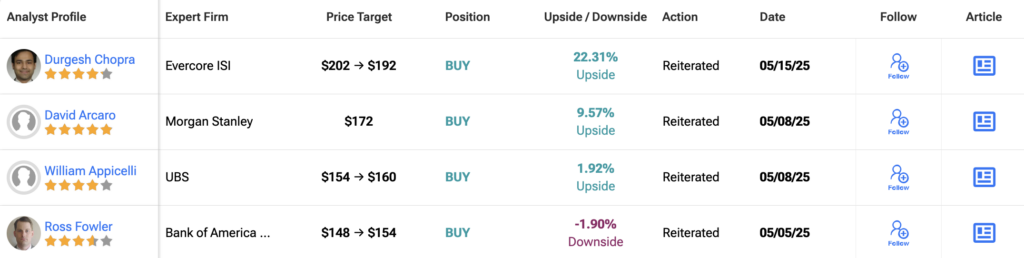

On TipRanks, Vistra (VST) holds a Strong Buy rating from 8 analysts — six say Buy, two say Hold, and not a single Sell in sight. The average 12-month VST price target is $157.88, which implies modest upside from current levels. But bulls are clearly still in the driver’s seat, with the high forecast hitting $192.00, and even the lowest estimate landing at $120.00.

BMO Capital’s James Thalacker reiterated his Buy rating and slapped a $191.00 target on the stock, pointing to the company’s strategic $1.9B gas acquisition as a key reason. He expects the deal to be immediately accretive to free cash flow, boosting returns via buybacks and dividends. Thalacker also flagged Vistra’s clean-energy arm, Vistra Zero, as another engine of earnings momentum.

Morgan Stanley backed that view too, maintaining a Buy with a $172.00 target as of today.