Vishay Precision Group delivered better-than-expected sales in the fourth quarter as the producer of precision sensors and sensor-based systems saw an increase in demand for its products.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meanwhile, shares of Vishay Precision (VPG) fell 5.5% as the company posted earnings per share (EPS) of $0.43 during the fourth quarter, which were in line with analysts’ expectations.

Revenue increased 9.1% year-on-year to $75.45 million topping analysts’ estimates of $70.92 million. Gross margin rose to 38.1% from 35% in the comparable year ago period. The increase in 4Q revenues was attributable to 23% increase in foil technology products, higher precision resistors sales and a 8% increase in force sensors sales.

For fiscal 2020, the company generated sales of $269.8 million, down from the $284 million posted in 2019. Diluted earnings per share came in at $0.79 versus $1.63 in the comparable year-ago period.

Vishay precision CEO Ziv Shoshani said, “11.7% sequential growth in 4Q sales reflected broad based growth across the company’s businesses and across our diversified end markets.”

Consolidated orders grew sequentially in 4Q as many of its markets continued experience a rebound from the pandemic lows.

Looking ahead to 1Q, Vishay Precision sees revenues land between $63 million to $70 million on the back of an improving business environment, strong cash flow and strategic investments . (See Vishay Precision stock analysis on TipRanks)

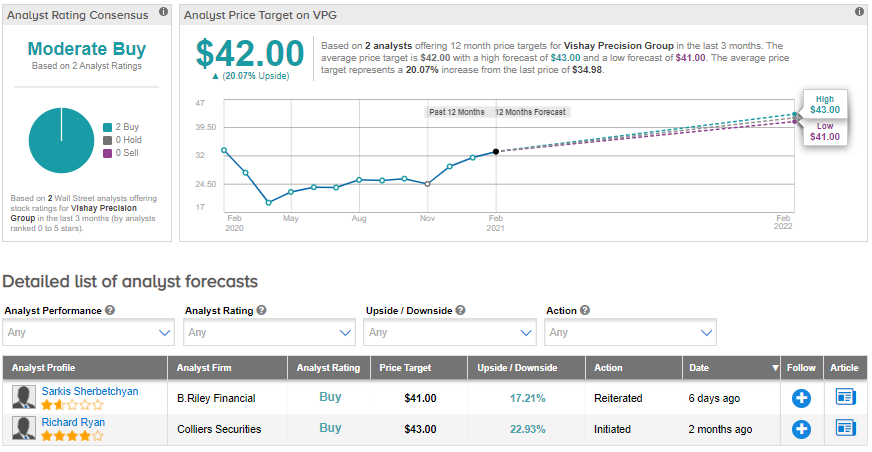

On Feb. 11 B. Riley Financial analyst Sarkis Sherbetchyan raised Vishay Precision’s price target to $41 (17% upside potential) from $34 and reiterated a Buy rating. Sherbetchyan continues to like Vishay precision’s “differentiated” technology, its ability to drive incremental flow through on rebounding sales volume and “robust” net cash position.

The rest of the Street has a Moderate Buy consensus rating on the stock based on 2 Buys. The average analyst price target of $42 implies about 20% upside from current levels.

Related News:

RingCentral’s 2021 Guidance Tops Estimates After 4Q Beat

IPG Photonics Posts Profit In Fourth Quarter; Shares Gain

Denny’s 4Q Revenues Miss Estimates Due To COVID-19 Pandemic