Visa announced that total U.S. payment volumes rose 9% in February, which is lower than the 11% growth registered in January, due to unfavorable weather conditions and a lower benefit from stimulus-related spending.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

While the growth rate decelerated slightly, Visa (V) said that the improvement in February’s payment volumes was due to a 22% rise in Debit volumes and a 4% decline in Credit volumes.

Furthermore, total cross-border volumes declined 16% year-over-year in February, showing an improvement over January’s decrease of 21%. Cross-border volumes excluding intra-Europe transactions declined 26% year-over-year in February but improved from a 32% decline in January.

The company said, “This improvement was due to card not present excluding travel volume growth accelerating to 27% as well as the lapping of lower 2020 travel related cross-border spend.”

Global processed transactions rose 2% year-over-year in February, but were 1% lower than in January, due to adverse weather conditions in the U.S. and restrictions amid the COVID-19 pandemic. (See Visa stock analysis on TipRanks)

Visa reported better-than-expected 4Q results in January, where earnings of $1.42 per share came in ahead of analysts’ estimates of $1.28. Revenues of $5.7 billion also topped the consensus estimate of $5.5 billion.

Ahead of its earnings, Bernstein analyst Harshita Rawat reinstated coverage on Visa stock with a Buy rating and a price target of $232 (5.3% upside potential). In a note to investors, the analyst said that she remains upbeat on Visa’s earnings and sees a recovery in cross-border volumes.

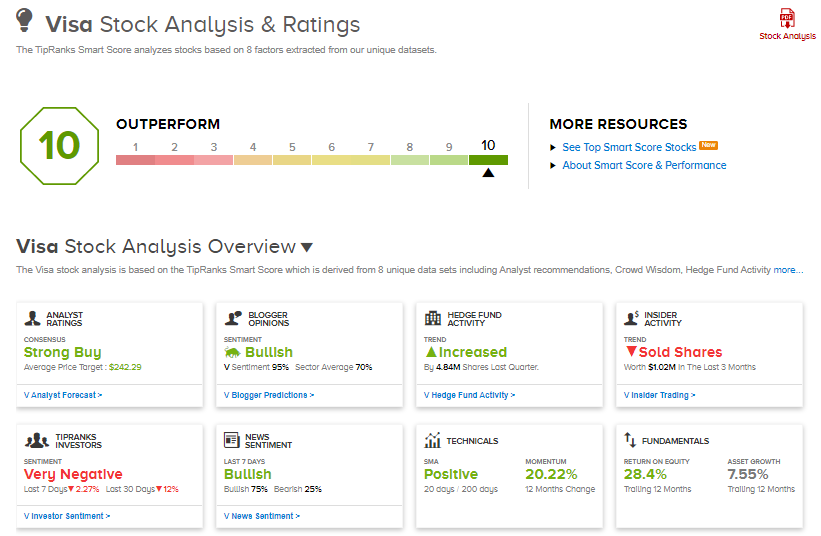

Overall, consensus among analysts is a Strong Buy based on 13 Buys and 2 Holds. The average analyst price target of $242.29 implies upside potential of about 10% to current levels. Shares have gained around 16% over the past year.

Furthermore, Visa scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Stitch Fix Plummets 22% In Pre-Market On Softer FY21 Revenue Outlook

Waitr Disappoints With 4Q Results; Shares Slide 15%

ContextLogic’s 1Q Revenue Outlook Exceeds Expectations After 4Q Beat; Shares Rise