Vir Biotechnology (NASDAQ:VIR), an immunology company announced a strategic business update where it will aim to reduce its operational expenses and will focus on investment areas that have a high potential for value creation.

As a result, the company will close its R&D facilities in St. Louis, Missouri, and Portland, Oregon in 2024. Vir will also lay off 12% of its workforce or around 75 employees due to the “discontinuation of its innate immunity small molecule group which was initiated in the third quarter of 2023.”

Vir expects to incur charges between $30 million and $40 million, primarily related to the closures of its research facilities and employee severance costs that are likely to be recognized in the third quarter of next year. Due to this restructuring, the company anticipates lowering its costs by at least $40 million annually.

Is Vir Biotech a Buy?

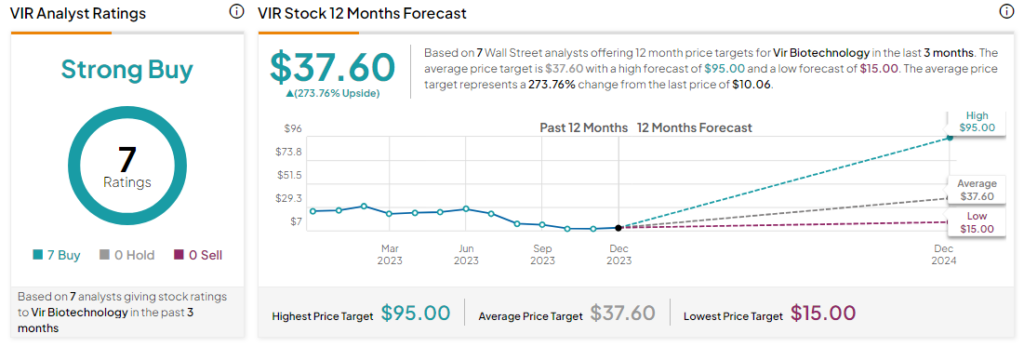

Analysts remain bullish about VIR stock with a Strong Buy consensus rating based on seven unanimous Buys. In the past year, VIR has tanked by more than 60% and the average VIR price target of $37.60 implies an upside potential of more than 200% at current levels.