Investors looking for a steady income stream can consider investing in dividend stocks. These stocks also have the potential to generate long-term capital gains. Thus, using the TipRanks Stock Screener tool, we have shortlisted two stocks – VICI Properties (NYSE:VICI) and Star Bulk Carriers (NASDAQ:SBLK). These stocks offer a high dividend yield, and their 12-month price targets reflect an upside potential of over 10% projected by analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s take a closer look at these stocks.

Is VICI a Dividend Stock?

VICI Properties is a real estate investment trust (REIT) that owns gaming, hospitality, and entertainment properties. Importantly, the stock has a dividend yield of 5.78%, compared with 3.91% for the real estate sector.

The company’s efforts to diversify away from the gaming segment bode well for long-term growth.

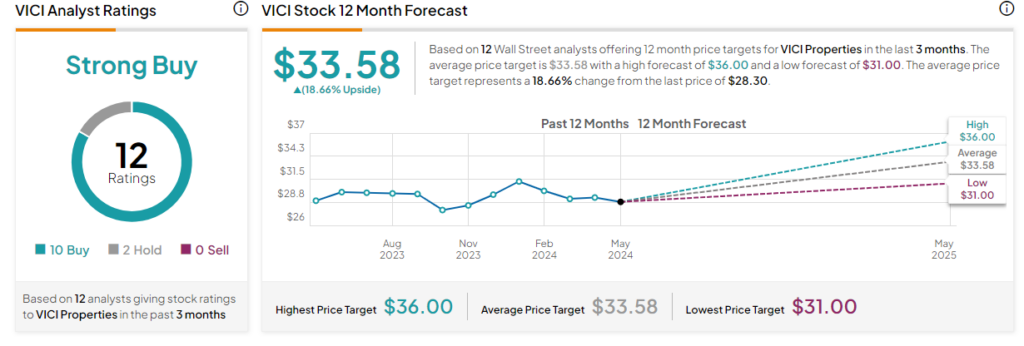

Overall, VICI’s Strong Buy consensus rating is backed up by 10 Buy and two Hold ratings. The analysts’ average price target of $33.58 points to 18.66% potential upside in the next 12 months. VICI stock is down 2.2% over the past year.

Is SBLK a Good Dividend Stock?

Star Bulk Carriers is a dry bulk shipping company that transports essential commodities like iron ore, coal, and grain across international waterways. The stock has a dividend yield of 5.26%, far more than the industrial goods sector’s average of 1.64%.

Rising shipping rates due to several factors, like geopolitical tensions and a limited supply of new vessels, could result in higher revenue for SBLK. Moreover, the company’s strong capital position keeps it well-positioned to pursue strategic expansion.

SBLK has received three Buy and one Hold recommendations for a Strong Buy consensus rating. Further, analysts’ average price target on SBLK stock of $29.75 implies a 10.23% upside potential. The stock has gained 63.2% over the past year.

Concluding Thoughts

Investors seeking a reliable passive income stream could consider both VICI and SBLK stocks. Both companies boast an impressive dividend yield and remain well poised for growth in the near term. Furthermore, both stocks carry an Outperform Smart Score of nine, which points to their potential to beat the broader market.